By the same token self employed taxpayers whether they are sole proprietorships or owners of corporations are also not required to pay employment insurance EI premiums. March 15 2020 to March 14 2021.

Small Business Owners Get Relief From Ei Premium Rates Advisor S Edge

Small Business Owners Get Relief From Ei Premium Rates Advisor S Edge

Tax Tidbits for Small Business Owners.

Ei for business owners. The journey of purchasing a homeDepending on the size of the homehouse owners insurance. Applies for EI benefits. Maternity parental sickness or compassionate care benefits.

One of the costs that you will need to be aware of as a business owner is employment insurance EI. However if you are a contract worker such as a barber or taxi driver you should use the regular EI program. Self employed individuals as well as business owners including their immediate family with over 40 ownership in a company are exempt from EI.

As the business owner you face a significant loss of income if your business is forced to close. During the claim period will be considered selfemployed. Global opportunity in over 180 countries.

For example in 2012 employers will pay 1176 for each insurable employee who earns about 46000 or. Business owners COVID-19 emergency support measures Details available as of September 28 2020. Hiring Credit NAICS Code and EI Contributions for Corporate Owners March 15 2013 Ronika Khanna It can be difficult for small business owners to keep on top of the myriad of tax rules interpretations and changes.

New small business owners can often underestimate the costs associated with hiring and are often unaware that additional costs need to be paid whether or not your business is profitable. If you run your own business or control more than 40 of your corporations voting shares this program can provide you with access to special benefits as early as 12 months after registering. The business must have been in operation for one year instead of the usual two.

Work-sharing program provides EI benefits to workers with reduced hours helping avoid layoffs Extended to 76 weeks from 38. There are several ways employees are considered to be related to the employer. Behrens of The Behren Law Firm in Weston Fla says that if you are a self-employed owner of a business that stops doing business and has filed and paid payroll taxes and unemployment taxes you should be.

Debt consolidation is when you the business owner roll short-term funding loans like Merchant Cash Advances MCA into one loan. At ei Funding for example we can also help with debt consolidation and PO. Eligible Registrants If you own your own business you may register for special benefits.

There is help available for you. We made temporary changes to the Employment Insurance EI program to better support Canadians who need financial assistance. This lowers both the amount of interest you pay out as well as the payback period for your loans.

Any sector or industry. Employment Insurance EI program. Under the Employment Insurance Act employees who are related to their employer individual or corporation might not be in an insurable employment.

Both are actively involved in running the business. This also includes people who own more than 40 of a corporation and farmers. The economic impact of the COVID-19 pandemic is being felt widely throughout the business community and has prompted the federal government to propose several financial support measures.

You can register if you operate your own business or if you work for a corporation but cannot access EI benefits because you control more than 40 of the corporations voting shares. Global opportunity in over 180 countries. This means that they would not have EI premiums deducted from their pay and would not be able to get EI benefits.

Ad There is no manner around wanting house owners coverage in case you are about to embark on. While collecting EI benefits any income of ABC Inc. Business owners can apply for support until June 30 2021.

As of September 27 2020 the minimum benefit rate for EI regular claimants is 500 per week before taxes in most cases. Simple system - Unlimited earning potential. You must also be either a Canadian citizen or a permanent resident of Canada.

Ad Join one of the worlds fastest-growing business opportunities in the world. You can apply for the EI Program which could allow you to be eligible for the following benefits. Ad Join one of the worlds fastest-growing business opportunities in the world.

Simple system - Unlimited earning potential. Premiums can cost the employee and employer more than 2000 each year. Both the husband and wife are considered self employed since they are both actively involved in running the business.

Can I claim EI if I am self employed. EI has a program designed for self-employed people. A self employed individual also includes business owners who own 40 of a corporation and usually extends to family members of self employed people.

Through CRAs My Business Account or Represent a Client. That means neither the company nor the employee should be paying EI premiums.

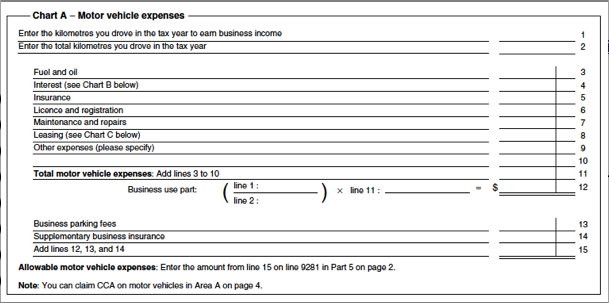

However if you use your life insurance policy as collateral for a loan related to your business including a fishing business you may be able to deduct a limited part of the premiums you paid. If you are filing your Canadian income tax as a sole proprietor or partner using the T1 tax return when you are filling out Form T2125 Statement of Business or Professional Activities you will be listing various business expenses.

Cra Form T2125 Everything You Need To Know Bench Accounting

Cra Form T2125 Everything You Need To Know Bench Accounting

A business can claim only half the CCA allowable for some assets in the year of purchase.

Business expenses cra. In a previous blog Gabrielle Loren founding partner of Loren Nancke Chartered Professional Accountants explained the importance of tracking your business mileage. CRA requires an annual information return to be filed stating all payments made to construction subcontractors. The Canada Revenue Agency CRA allows you to deduct expenses for the business use of your home if it is your main place of business or if you use the space to earn your business income.

A taxable benefit for their cost. The CRA has a list of the common business expenses that you can deduct. The CRA defines business expenses as a cost you incur for the sole purpose of earning business income Typical expenditures include money spent on buying inventory to sell or the costs associated using your personal car for business reasons.

These telephone expenses may include a home phone if the company office is located in the home. Computer and other equipment leasing costs. For example if in the current tax year you purchased some applications software for your business you would be.

All of your claimed business expenses on your income tax return need to be supported with original documents such as receipts. CRA agreed these meals were legitimate business expenses and did not assess CL. The CRA allows business owners to claim a reasonable portion of their vehicle expenses back as a tax deduction.

You have to support business expense claims with a sales invoice an agreement of purchase and sale a receipt or some other voucher that supports the expenditure. This can be applied to most expenses relating to a vehicle. But these expenses must involve repairs not improvements.

Common Business Expenses The CRAs business expenses index lists many common business expensesfrom accounting to utilitiesand explains the income tax deductions rules relating to each expense. Deduction of Business Expenses Indirect Tax Audit Techniques Absent a specific statutory provision to the contrary expenses incurred for the purpose of earning income from business or property are deductible for tax purposes. This is commonly referred to as the half-year rule.

Generally all businesses can deduct from their income expenses that are incurred not only to make the business operational but also to maintain that business once it is up and running. In most cases you cannot deduct your life insurance premiums. Without the evidence from receipts for your claimed business expenses the Canada Revenue Agency CRA may decide to.

Business tax fees licenses and dues. The general rule is that you cannot deduct outlays or expenses that arent related to earning business income. Accounting and legal fees.

If you pay cash for any business expenses be sure to get receipts or other vouchers. The following may be considered when determining operating expenses. If your business depends on delivery vehicles fuel and repairs are legitimate expenses as are maintenance costs for a building.

Telephone expense paid on phone and fax lines for a business space and used specifically for business purposes are fully deductible. If you buy something for both personal and business reasons you may deduct the business portion of the expense. The cost of a personal computer is not deductible if you use it to play computer games.

The Canada Revenue Agency CRA defines a deductible business expense as any reasonable current expense you paid or will have to pay to earn business income. You cannot deduct purely personal expenses as business expenses. A business expense is a cost you incur for the sole purpose of earning business income.

Some of the most common deductible expenses include motor vehicle and meals and entertainment expenses. CRA Business Expenses Need a Reasonable Expectation of Profit. The insurance costs related to business use of workspace in your home have to be claimed as business-use-of-home expenses.

The issue more often than not is convincing a CRA tax auditor that an expense was in fact incurred by the business. Also indicated that the corporation also paid for meals for his helpers but since his corporation had neither employees nor formal subcontractors CRA considered those meals a taxable benefit. The Canada Revenue Agency CRA allows you to claim only 50 percent for Meals and Entertainment where these would be classified.

If your business expenses exceed your business income you will record a business loss on this form. Heres how to claim business use of home expenses in Canada on your taxes. If so you can deduct the percentage of the lease costs that reasonably relates to earning your business incomeYou can also deduct the percentage of airtime expenses for a cellular telephone that reasonably relates to earning your self-employment income.

Interest and bank charges.

Launch your small business. The Saskatchewan government provides government funding to small business owners in Saskatchewan making it one of the better provinces in Canada to start a small business.

70 Best Online Business Ideas For Home Business In Saskatchewan

70 Best Online Business Ideas For Home Business In Saskatchewan

During the registration process you can also request the Saskatchewan Workers Compensation Board contact you with details regarding how to register with the Saskatchewan Workers Compensation Board.

Starting a small business in saskatchewan. Starting up a new business in Saskatchewan requires business licensing and permits and business registration online. Small business funding in Saskatchewan is available for a number of industries and a variety of different funding purposes such as. Companies Accounting Tax Visas Audit Research.

Create a business plan. Register your business get permits and licences and learn about business costs and support. Search Faster Better Smarter.

Getting Started The Saskatchewan Corporate Registry provides services including. You can go via a skills program study and start working after your graduation or buystart a business in Canada. Immigration Matters - Starting a small business in Saskatchewan.

Understanding the process of starting and maintaining a business in Saskatchewan is very important and something you should invest some time into before opening up your own business. Ad Find Funds For Business. If you are ready to start your business in Saskatchewan dont wait any longer.

In 2019 small businesses accounted for 23 of Saskatchewans GDP. Comprehensive Integrated Corporate Services. You can now register your business online in Saskatchewan which is preferred by the ICS.

Apply for funding. To start this click here. Ad Set Up Your Company Anywhere In Indonesia.

Top Rated B2B Companies are Hiring Fresher and Senior - 1200 Openings. You will need to create a log-in account with the Corproate Registry. Why small business funding.

Our team of small business experts here at CanadaStartups helps you start your business to build your business plan to search for small business grants in Saskatchewan loans tax breaks and private investment programs as you will have access to all available funding programs in Saskatchewan and the rest of Canada. In fact the Government of Canada reports that there are 40453 small businesses companies employing up to 99 employees in Saskatchewan alone. Ad Find Funds For Business.

Today we will be examining the success story of an immigrant from the. Have the business plan checked. Register your business and apply for applicable licenses and permits Before opening your business you will need to pick a name and register your business.

Register your Business Once you have reserved a business name and have gathered the required information you can register your business. Get the business idea. Comprehensive Integrated Corporate Services.

Small businesses can - and do. The steps of starting a small business in Saskatchewan are simple. Maintaining a registry of names.

For that reason along with so many more Community Futures has created a helpful guide 12 Great Reasons to Start a Small Business. Managing a Child Care Business As our province grows so does our need for quality child care. And enforcing registration and compliance requirements.

Companies Accounting Tax Visas Audit Research. Ad Set Up Your Company Anywhere In Indonesia. Search Faster Better Smarter.

- succeed across rural Saskatchewan every day and they are built by people just like you. Registering sole proprietorships or partnerships. To help you startup to pay for training and support to.

OCT 12 2020 ROBYNN FARRELL. Ad Find Latest B2b Agencies Job Vacancies In London On Receptix. If you are a small business owner either considering starting up a small business in Saskatchewan or are expanding your existing business government funding may be an option for you to consider In addition to that if you are in need of funds from a third party other than personal funds family friends or local banks government funding options are a great way to succeed.

There are really three major ways to immigrate to Canada. Start your funding search. Doing this online will be cheaper and take less time.

Speak to your IDP study counsellor to get up-to-date course prices. Over 80 New And Buy It Now.

Frame Diploma Infused Black Campus Store

Frame Diploma Infused Black Campus Store

The Business Administration Department at Red River College on Academiaedu.

Business administration red river college. Ad Get Administration With Fast And Free Shipping For Many Items On eBay. Fast-Track Programs Jump into the workforce sooner and grow. This Is The New eBay.

Red River College is a member of Polytechnics Canada which is a cooperative association between the eleven leading research-intensive publicly funded colleges and institutes of technology. Business Administration BA provides the student with a broad business foundation during the first year of studies. Ad On this webinar you are going to discover some top-secret strategies tools.

Ad On this webinar you are going to discover some top-secret strategies tools. Ad Get Administration With Fast And Free Shipping For Many Items On eBay. Shop For Top Products Now.

Business Administration and Management General. Business Administration and Management General. Red River College endeavours to provide the most current version of all program and course information on this website.

Please be advised that classes may be scheduled between 800 am. Shop For Top Products Now. Post-graduate Diploma in International Business from School of Business and Applied Arts fees admission eligibility application scholarships ranking.

During the second year of the program the student will declare a major that focuses their studies in a particular. Diploma in Business Administration from School of Business and Applied Arts fees admission eligibility application scholarships ranking. Red River College offers a variety of business-focused programs that give you the tools you need to make an impact in the business world.

How to make money online fast and easy in 2021 Free webinar with bonuses. The world of business is more than a great career its about mastering a skill set innovation and making your mark. This Is The New eBay.

The College reserves the right to modify or cancel any course program process or procedure without notice or. Over 80 New And Buy It Now. The total student population at the Red River College across all campuses is more than 30000 students of which over 800 are international students.

50 with binder 2- Accounting Principles Volume 2. Winnipeg Canada Area Owner Lawn N Order Custom Landscapes Construction Education Red River College 1994 1996 Business Administration Marketing Oak Park high school 1991 1993 Ftench immersion diplomat Experience Lawn N Order Custom Landscapes April 1994 - Present Ditchfield Soils Limited November 2009 - Present Stop Shine Carwash Ltd. CAD 28567 Program fees are indicative only.

How to make money online fast and easy in 2021 Free webinar with bonuses. Business Administration BA provides the student with a broad business foundation during the first year of studies. Used books for Business Administration Red River College 1- Statistics 11e.

65 with binder 3- Marketing The core - 40 4- Business Mathematics - 40 5- Exploring Macro Economics - 40 6- Using Sage 50 -. View course View institution. Students must achieve a minimum grade point average of 300 on their Business Administration Diploma University Stream to be eligible for admission to the Joint Program.

Diploma in Business Administration Red River College. Rate your chances of admission in Red River College of Applied Arts Science Technology Diploma in Business Administration program. Rate your chances of admission in Red River College of Applied Arts Science Technology Post-graduate Diploma in International Business program and download course brochure.

Winnipeg Manitoba Canada Accounting Accounting Education Red River College 2015 2016 Certificate of Accounting Fundação Getulio Vargas 2011 2013 Master of Business Administration MBA Imes Catanduva College 1999 2002 Bachelor of Arts in Computer Science Experience CA September 2012 - February 2014 CA July 2010 - August 2012 IBM October 2008 -. Admission to the Asper School of BusinessRed River College Joint Program is limited to an annual quota and is competitive.

Trucking business for sale Box truck business - 30000. Owners have done all the heavy.

37618 Nationwide Epa Awarded Trucking Business For Sale In Nebraska Bizbuysell

37618 Nationwide Epa Awarded Trucking Business For Sale In Nebraska Bizbuysell

TransportDistribution Businesses for Sale.

Trucking business for sale. The second approach is to purchase or lease a truck and work as an independent trucker servicing your own accounts or subcontracting for a transportation firm. Browse 434 Transportation Businesses for sale on Florida Moving and Trucking Companies for Sale. Sydney New South Wales Australia Description.

Trucking Companies for Sale All Businesses for Sale in Miami-Dade County Florida Based Freight Hauling Company Miami-Dade County FL Asking. Want to be your own boss. Transport-Freight Business for Sale - Secure Corporate Contracts in Place -Turnover 400000 - Includes 3 Vehicles and Equipment - Easy-to-Run - only 400000.

This family run business is well established and is 48 years old located in central North Carolina is a special niche trucking firm. Turnkey OTR Over the Road trucking operation for sale. Our typical 1 to 3-truck package includes over the road tractors with sleepers drivers and a dispatch team Our routes cover all 48 states and average over 259 per mile to the truck Weekly gross from 5000 to 9500 per truck Weekly profit 30-55 per truck after expensives You receiver your pay in 7days unlike most business that have net45 Hard financials are available for serious inquiries This business.

The business has been operating for approximately 25 years. Long Haul Trucking Company - Price Reduced - Motivated Sellers. The business comes with secure contracts and has huge growth potential.

Crude Oil Trucking Company For Sale. A great base of business to build on. Transport-freight Business For Sale - Secure Corporate Contracts In Place -turnover 400000 - Includes 3 Vehicles And Equipment - Easy-to-run - Only 400000.

Refine your search by location industry or asking price using the filters below. Browse through Canada Trucking Businesses For Sale at DealStream. BizQuest has more Transportation business for sale listings than any other source.

Nebraska Transportation Businesses for Sale 2 Over 8911 Businesses For Sale. There are several advantages to buying an existing Trucking business with an established customer base when compared to starting a new business and it may also be easier to finance an existing business. This organization primarily operates in the Contract Haulers business industry within the Motor Freight Transportation sector.

491 Business for Sale Results. Sellers are ready to retire. Trucking business for sale Box truck business.

If you find a business broker who will work in your interest not only in the interest of the seller then you wont have any problem when negotiating. Transport-Freight Business for Sale - Secure Corporate Contracts in Place -Turnover 400000 - Includes 3 Vehicles and Equipment - Easy-to-Run - only 400000. There are many transport and distribution opportunities in New Zealand.

The business comes with secure contracts and has huge growth potential. There are business opportunities for truck business owners distributorships and delivery services. Their main line of business is Sand and Stone hauling from sand pits and rock.

Trucking Logistics Business for Sale in NJ Middlesex County NJ Logistics Companies 270000. This is ideal for someone looking to break into the trucking and logistics industry. This is a great opportunity to acquire this well-established transport business for sale in Sydney.

Listing ID 33429 Trucking Logistics Company. Whether you are looking to buy a Transportation business for sale or sell your Transportation business BizQuest is the Internets leading Transportation business for sale marketplace. UPS to Sell Freight Trucking Business to TFI for 800 Million In exiting truck cargo UPS to focus on parcel-delivery network UPS Freight generated an estimated 315 billion in 2020 revenue.

This is a great opportunity to acquire this well-established transport business for sale in Sydney. View 210 Transport Storage businesses or franchises for sale on SEEK Business and turn your dreams into reality. Trucking Company now available for sale is located in Burlington County New Jersey.

The sale price includes one truck 6 dry vans and 1 flat bed. As the economy grows so does the demand to transport goods across the various cities in NZ. 491 Business for Sale Results.

This is a great opportunity to acquire this well-established transport business for sale. When negotiating for a trucking business that is for sale you will have to be careful not to make it a complicated process. Over 20000 businesses properties franchises and investments for sale in 50 countries.

Turnkey OTR Over the Road Trucking Operation Company. Price has been reduced to 1000000 to sell quickly. Selling our trucking business which includes our MC Number 35 months old our box truck and the list of brokers weve worked with.

If you are interested in starting a small Trucking business buying an established Trucking business for sale or an existing Trucking franchise for sale near you can be one of the best ways to start your own small business.