Your Canadian income tax refund depends on your total annual income your deductions and how much tax you have already paid or had withheld at source. 2 weeks when you file online.

Apply For A Canadian Tax Refund Workingholidayincanada Com

Apply For A Canadian Tax Refund Workingholidayincanada Com

A Canadian tax return refers to the obligatory forms that must be submitted to the Canada Revenue Agency CRA each financial year for individuals or corporations earning an income in Canada.

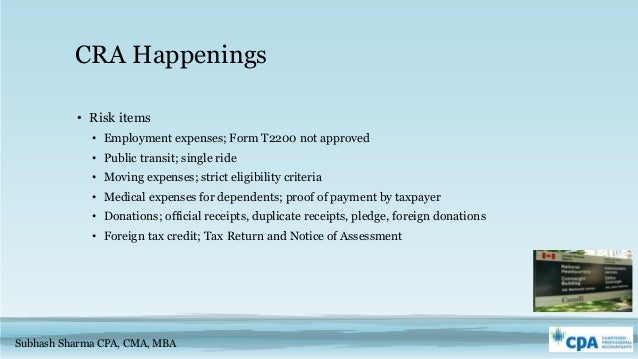

Canadian income tax refund. Residents are taxed on their worldwide income and while non-residents must declare all their income including worldwide they only pay tax on income earned in Canada. When you file your tax return on or before your due date CRA will send a Notice of Assessment and any applicable refund within. The CRA will start paying refund interest on the latest of the following 3 dates.

Canada will tax you on your worldwide income including your US. The date of the overpayment the 120th day after the end of the tax year if the return for the year is filed on time. For paper tax returns filed before April 15 wait four weeks before you check on your refund.

8 weeks when you file a paper return. If you are getting money back it will be added to your refund. As a resident of Canada under the treaty you can claim a reduced withholding rate from the United States on the dividend income 15 rather than 30 and Canada generally allows you to deduct the US.

Double-tax credit if any of your income is also taxed by a country that has a tax treaty with Canada. The length of time it takes the CRA to process your income tax return and refund depends on how and when you file your return. In Canada you can earn up to a certain amount without paying tax.

Whether you are a Canadian resident or not you normally must file an annual tax return to declare taxable income. File income tax get the income tax and benefit package and check the status of your tax refund. Withholding tax from your Canadian tax on that income.

Free Canadian income tax calculator quickly estimates your income tax refund or taxes owed federal and provincial tax brackets plus your marginal and average tax. If you received COVID-19 emergency or recovery benefits in 2020 you must report these amounts on your income tax and benefit return. The return paperwork reports the sum of the previous years January to December taxable income tax credits and other information relating to those two items.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return. In 2019 this was 12069. File your income taxes find filing and payment due dates what needs to be reported and can be claimed as deductions and how to check the status of your tax refund.

Processing Times for Paper Returns Paper returns usually take four to six weeks to process. The Canada Revenue Agencys goal is to send your refund within. As a non-resident your non-Canadian income will not be taxed in Canada but it will affect how many non-refundable tax credits you can claim.

Everyone who works in Canada will pay income tax on their earnings but there is a tax-free allowance. These timelines are only valid for returns we received on or before their due dates. Most Canadian income tax refunds are issued in anywhere from two weeks to 16 weeks depending on the type of return and when you filed it according to the Canada Revenue Agency CRA.

Key elements of the calculation include but are not limited to the applicable Federal and Provincial tax rates whether you have Non-Refundable Tax Credits or whether you can subtract any. Updates on changes to the Canada Revenue Agency CRA services due dates and programs affected by the pandemic. This is your personal tax credit otherwise known as your tax-free threshold.

Yes the Canada Revenue Agency will pay you compound daily interest on your tax refund. If you owe money it will be subtracted from your tax bill. COVID-19 benefits and your taxes.

You will be able to offset any tax owed with. Business or professional income Calculate business or professional income get industry codes and report various income types. The schedule 14 form can be found here.

Anyone that lives in the four provinces will need to claim it as part of their federal tax return.

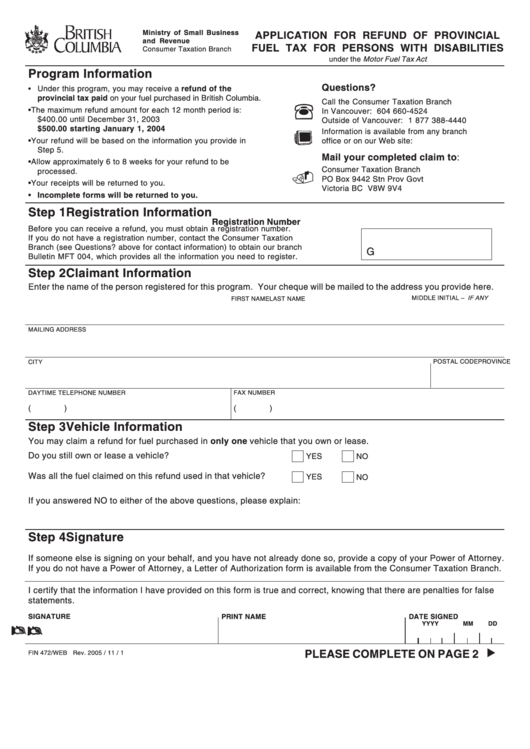

The refund program has a maximum refund amount of 500 for each calendar year. Use this form to apply for a refund of motor fuel tax if you purchased fuel within BC for your own use in any of the circumstances listed below.

Https Stratossolutions Com British Columbia Bulletin Mft 002 Motor Fuel Tax Refunds Purchasers

We consider the.

Fuel tax refund bc. Effective January 1 2014 you are. Provincial fuel tax you pay on fuel used in your vehicle based on your fuel receipts. PO Box 9435 Stn Prov Govt Victoria BC V8W 9V3 Questions.

If you qualify youre eligible for. If you have a qualifying disability the fuel tax refund program allows you to request a refund of the provincial motor fuel tax you paid in BC on fuel you used in a vehicle you own or lease. This notice explains who is eligible to claim and receive a PST motor fuel tax or carbon tax refund.

For more information see Form XE8 Application for Refund of Federal Excise Gasoline Tax on Gasoline. ETaxBC online services You can manage your account file returns and make payments online using eTaxBC. Regfaxgovbcca 18773884440 Persons with a disability are eligible for a refund on motor fuel tax they have paid on fuel purchased for their motor vehicles and may receive up to 500 per calendar year for the cost of fuel used by their leased or owned vehicle.

Information on how to apply for a Fuel Tax Refund. A refund is also for persons who have remitted to the Minister amounts in excess of the tax collectable or payable. A refund is for tax that has been overpaid or incorrectly paid and is returned to a business or individual under a taxing statute or regulation.

When you purchase fuel in BC you pay fuel tax. Only the person who paid the tax is eligible for a refund. You are a farmer and purchased clear fuel for use in a farm.

Space heating fuel is also eligible. The refund program has a. You must apply for the refund within four years from the date you paid the tax.

If you have a qualifying disability the fuel tax refund program allows you to request a refund of the provincial motor fuel tax you paid in BC on fuel you used in a vehicle you own or lease. Refunds are available for off-road commercial vehicles used in farming fishing hunting outfitting logging mining sawmills tourism trapping golf courses and stationary generators. If you qualify youre eligible for a fuel tax refund of up to 500 each calendar year.

FOR THE FUEL TAX REFUND PROGRAM FOR PERSONS WITH DISABILITIES under the Motor Fuel Tax Act Mailing Address. If you import fuel into BC. You are a farmer and purchased coloured fuel for use in the operation of the farm and did not receive a point-of-sale exemption.

Start keeping your fuel receipts right away because youll need them when you apply for your. On fuel you used in a vehicle you own or lease. Once you register for the fuel tax refund program for persons with disabilities and receive your registration confirmation letter you can apply for a refund.

We calculate your refund based on the total amount of fuel tax that you paid during the. If you have a qualifying disability the fuel tax refund program allows you to request a refund of the provincial motor fuel tax you paid in BC on fuel you used in a vehicle you own. When you purchase fuel in BC you pay fuel tax.

Youre eligible to get up to 500 back each calendar year for the provincial motor fuel tax you paid when fueling your vehicle in BC. If you have a qualifying disability the fuel tax refund program allows you to request a refund of the provincial motor fuel tax you paid in BC. When you purchase fuel in BC you pay fuel tax.

If you pay carbon tax on coloured fuel purchases on or after January 1 2014 you may apply for a refund by completing an Application for Refund of Carbon Tax Purchaser of Fuel FIN 108. The refund program has a maximum refund amount of 500 for each calendar year. 2 If a farmer purchases coloured fuel that does not qualify for exemption under subsection 1 the farmer must pay tax at the time of purchase and may claim a refund of the tax paid on the coloured fuel.

Coloured Fuel Sellers. Information is available on our website at govbccafueltaxrefund Program Information. Refunds and Rebates Fuel Tax.

If you require additional information call us toll-free at 1 877 388-4440. A qualified medical practitioner must certify the impairment. Or manufacture fuel in BC.

The refund program has a maximum refund amount of 500 for each calendar year. If you have a permanent mobility impairment and cannot safely use public transportation you can ask for a refund of part of the federal excise tax on the gasoline you buy. 3 To claim a refund of the tax paid in accordance with subsection 2 on coloured fuel a farmer must submit to the director the following.

Of the provincial fuel tax you pay on fuel used in your vehicle based on your fuel receipts. A rebate is for tax properly paid and is subsequently. Tax Administration branch Department of Finance.

For your own use you must pay motor fuel tax and carbon tax on the fuel you use PDF. Required to collect carbon tax on sales in BC to. Govbccasalestaxes PO Box 9442 Stn Prov Gov Victoria BC V8W 9V4 Who Can Claim a Refund Provincial Sales Tax Act Motor Fuel Tax Act Carbon Tax Act.

When you purchase fuel in BC you pay fuel tax.

In this case I believe that would be your GSTHST payable account. In Nova Scotia Newfoundland and Labrador and New Brunswick Ontario and Prince Edward Island the GST is blended with the provincial sales tax and is called the harmonized sales tax HST.

Applications for refund of HST paid in another participating province on qualifying goods imported into Ontario within 30 days must be submitted within one year from the date the qualifying goods were imported into Ontario.

Hst refund dates 2016. 01 June 2016 FREDERICTON GNB The provincial government is advising eligible New Brunswickers that they will receive their first HST credit payment in October. The personalized GSTHST return Form GST34-2 will show the due date at t he top of the form. Per year you could get up to.

If that is the case then this is what I would do. In four weeks if you filed a paper return. I also assume you claimed the HST ITC.

GSTHST Payment Dates in Canada 2021 Normally you will receive payments quarterly if you qualify for the GSTHST credit. Nipissing First Nation PO. For July 2021 to June 2022 payment period your.

When can you expect your refund. HST EXEMPTION SUPPORTING DOCUMENT REFERENCE 1 Anishinabek Nation Communities April 29 2016. Box 711 North Bay ON P1B 8J8.

For example for July 2020 to June 2021 payment period your 2019 tax return is used ie. For reporting periods ending before March 23 2016 enter on line 1100 the total amount of the sale prices for all of the grandparented housing that you sold in any of the 4 provinces Ontario Nova Scotia British Colombia or Prince Edward Island during this reporting period where the purchaser was not entitled to claim a GSTHST new housing rebate or a GSTHST new residential rental property. As a general rule when you get a refund you post it back to the account where the original entry was booked.

155 for each child under the age of 19. 592 if you are married or living common-law. 451 if you are single.

The goods and services taxharmonized sales tax GSTHST credit is a tax-free quarterly payment that is based on family income. In 1996 three of the four Atlantic provinces New Brunswick Newfoundland and Labrador and Nova Scotia entered into an agreement with the Government of Canada to implement what was initially termed the blended sales tax renamed to harmonized sales tax which would combine the 7 federal GST with the provincial sales taxes of those provinces. You have to include this amount on your GSTHST return for the reporting period that includes the last day of February.

After filing a GSTHST rebate claim. Payments are made on a July to June schedule and are based on your tax return for the previous year. If you do not receive your GSTHST credit payment on the expected payment date please wait 10 working days before you contact us.

You must claim your rebate within 24 months of the sale or renovation. Add line 103 and line 104 and enter the result on line 105If you file a paper return enter this amount on Part 1 and Part 2 of the return. The Canada Revenue Agency usually send the GSTHST credit payments on the fifth day of July October January and April.

If you provide the Ontario First Nations point-of-sale relief the amount of HST collected or collectible on the supply must be included in the line 105 calculation at the full 13. The date you transfer ownership to the purchaser. UNION OF ONTARIO INDIANS Head Office.

They will need to fully meet their GSTHST and QST filing obligations by June 30 2016. The due date of your return is determined by your reporting period. For most GSTHST rebates your claim will be assessed after the Canada Revenue Agency CRA receives your application and you will be sent a notice of assessment in one of the following ways.

You can claim the GSTHST on the land purchase fees the construction and the interest if you pay the tax before applying for the rebate. I have included three snap shots above. The date the construction or substantial renovation is substantially completed.

Through mail in My Business Account for which you will receive an email notification. In addition to filing GSTHST and QST annual information returns by this date some businesses will also have to file their GSTHST andor QST annual final return for selected listed financial institutions. Your net income for 2019.

If you have not included all the necessary information and completed your return correctly processing of your refund could be delayed. The HST credit will help low- and middle-income families and will provide about 100 million in direct financial support to New Brunswickers said Finance Minister Roger Melanson. If you are closing a GSTHST account you need to file a final return.

4262016 Details Canada - English - KPMG - Research - Canadian Tax Adviser Real Estate GSTHST Check-up - Meet Your Obligations Canadian Tax Adviser April 26 2016 As a real estate business you must carefully review and understand how your operations are affected by the GSTHST QST PST and other indirect taxes such as property taxes. Line 105 Total GSTHST and adjustments for the period. We can charge penalties and interest on any returns or amounts we have not received by the due date.

Generally we process as the GSTHST return as follows. Due to the emergency aid that the Canadian government is giving there will be an extra one-time payment on April 9. As part of this project the PST portion of the new HST.

For more information on the point-of-sale exemption for the Ontario portion of the HST available to Ontario First Nations. You are considered to have collected HST in the amount of 73029 at the end of February 2016. HST EXEMPTION SUPPORTING.

The number of children under 19 years old that you have registered for the Canada child benefit and the GSTHST credit. In two weeks if you filed electronically. Be sure to keep your personal information updated to avoid underpayments or overpayments.

The CRA has tweaked this GST refund in 2021 in light of the pandemic. How to maximize your GST refund.

One such tax credit is the Goods and Services TaxHarmonized Sales Tax GSTHST refund.

Cra gst refund. The CRA credits the. The CRA credits the GST refund into your account on the fifth day of every quarter. The CRA can audit your GSTHST return up to four years after submission.

The CRA credits the GST refund into your account on the fifth day of every quarter. The Canada Revenue Agency CRA offers refundable tax credits to Canadians who file their income tax returns. January 5 April 5 July 5 and October 5.

Where an excess amount of tax has been charged or collected. Last year the CRA gave an emergency GST refund that matched your July 2019-June 2020. The Quick Method of Accounting for GSTHST If your business does not normally qualify for GSTHST refunds that is the total GSTHST that you collect from sales is more than what you pay out for supplies you can elect to use the quick method of accounting for GSTHST.

If you are turning 19 this year the agency will issue the first GST refund on the payment date that comes after your 19th birthday. Or where consideration for a supply is reduced some time after the tax has been charged or collected. Those who didnt get this refund can claim it till December 2021.

The Canada Revenue Agency CRA gives a single person a maximum GST refund of 451 per year in four installments. About the GST refund. January 5 April 5 July 5 and October 5.

Refund adjustment or credit. Beyond 48000 a single individual gets no GST refund. The GST refund amount depends on the following conditions.

If you are turning 19 this year the agency will issue the first GST refund on the payment date that comes after your 19th birthday. If youd like to view your benefit information and amounts you can do so using the CRA My Account Service. When you file your income tax return CRA will automatically consider a GST refund.

The calculation will start on the latest of the following 3 dates. Each fiscal year the CRA will mail you a personalized GST34-3 return package that includes. How to maximize your GST refund.

Interest on your refund. The goods and services taxharmonized sales tax GSTHST credit is a tax-free quarterly payment that helps individuals and families with low and modest incomes offset the GST or HST that they pay. Have a refund of 2 or less.

An information sheet with your reporting periods and due dates an access code for filing your returns electronically on GSTHST NETFILE or by phone using GSTHST TELEFILE remittance vouchers to use if you make your payments at your financial institution. You can receive your payments via direct deposit to your Canadian bank account. The CRA gives GST refunds to low- and mid-income earners as it believes that they pay a higher portion of their income for buying taxable goods and services.

The 31st day after you file your return. Have any outstanding GSTHST returns from a sole proprietorship or partnership. When will I be eligible for a GST refund.

You are automatically considered for the GSTHST credit when you file your taxes. A supplier is permitted to adjust refund or credit GSTHST in two situations. This year the CRA gave a one-time emergency GST credit equivalent to your annual GST credit.

A family of three parents and a child can get a maximum GST refund of 755 in the July 2021-June 2020 period. Last year it paid generous COVID-19 benefits and delayed the tax-filing deadline to September 30. You must be at least 19 years old and resident in Canada at the beginning and the previous month of the month when the agency refunds the amount.

The Canada Revenue Agency will pay out the GSTHST credit for 2021 on these dates. The CRA will pay you compound daily interest on your tax refund for 2020. It may also include payments from provincial and territorial programs.

GSTHST NETFILE is an Internet-based filing service that allows registrants to file their goods and services taxharmonized sales tax GSTHST returns and eligible rebates directly to the Canada Revenue Agency CRA over the Internet. The Canada Revenue Agency CRA credited this tax-free emergency refund on April 5 2020.