Request SingPass CorpPass. Logs into primary or secondary forest products eg.

Income Tax Return Tax Return Income Tax Return Income Tax

Income Tax Return Tax Return Income Tax Return Income Tax

Login to your TurboTax account to start continue or amend a tax return get a copy of a past tax return or check the e-file and tax refund status.

Logging tax return. Client Notice of Transfer using CorpPass. When you lodge a tax return you include how much money you earn income and any expenses you can claim as. OK You are not a registered taxpayer.

Get Answers to Your Tax Questions. File Your Taxes for Free. Start for free today and join the millions who file with TurboTax.

If you did not send an online return last year allow extra time up to 20 working days as youll need to register first. Personal Tax with SingPass. Login to Iris by entering your Registration No.

Key information from your most recent tax return. Easily file federal and state income tax returns with 100 accuracy to get your maximum tax refund guaranteed. You do not have to complete your return in one go.

Business Tax with CorpPass. Lodging your tax return A tax return covers the financial year from 1 July to 30 June. If logs are manufactured into primary and secondary forest products a processing allowance may be deducted.

Navigate to the e-File tab -Click Response to Outstanding Tax Demand To view the tax demand or Click e-Pay Tax To generate the pre-filled Challan for payment. Your payment history and any scheduled or pending payments. If you process BC logs you must complete a Logging Tax Return of Income for Processors FIN 542P.

Get Your Tax Record. Internal Revenue Service An official website of the United States government. Sign in to file your tax return.

Online Account is an online system that allows you to securely access your individual account information. Get A 100 Accuracy Guarantee With HR Block for your US. Ad Trust The Experts At HR Block To Guide You Step By Step Through Your Expat Taxes.

Business Client with CorpPass Available for Desktop Tablet only Individual Client with CorpPass and IRAS Authorisation Code. Youll need to prove your identity using Government Gateway or GOVUK Verify. Instructions for logging tax return of income FIN 542S You must file the Logging Tax Return of Income if you had income from the sale of BC.

Lumber shakes shingles poles pulp paper etc. Logging income is generally gross revenue from logging operations less related operating expenses and is calculated according to Division B of the Income Tax Act Canada. Send your tax return by the deadline.

Once youve registered you can sign in for things like your personal or business tax account Self Assessment Corporation Tax PAYE for employers and VAT. Instructions for logging tax return of income for processors FIN 542P You must file the Logging Tax Return of Income for Processors if you processed BC. If you need to complete a tax return you must lodge it with us or have registered with a tax agent by 31 October.

Logs standing timber timber rights or the export of logs. Sign in to HMRC online services. You must file the return within six months of the end of the tax year in which logging operations occurred.

Your balance details by year. If logging income is recorded as a capital gain the logging tax applies to the taxable portion of the capital gain. The amount you owe updated for the current calendar day.

Click the Login to e-Filing Account button to pay any due tax intimated by the AO or CPC. Instead you must file the Logging Tax Return of Income for Processors FIN 542P to report all of your income from logging operations. Get A 100 Accuracy Guarantee With HR Block for your US.

With logging operations in BC. Ou require assistance in completing this form refer to If y Instructions for Logging Tax Return of Income. And Password which has been sent on your Cell No.

Get Coronavirus Tax Relief. Login to myTax Portal. TurboTax is the 1 best-selling tax preparation software to file taxes online.

Get Your Refund Status. The tax return must be filed within six months after the end of the tax year in which the logging operations occurred. Which is your CNIC No.

Ad Trust The Experts At HR Block To Guide You Step By Step Through Your Expat Taxes. The return must be filed within six months after the end of the tax year in which the logging operations occurred.

If you have not yet received your amended tax slips in time to meet the deadline you must file using the tax slips you have received. 1 Trusted by millions of Canadians for over 20 years.

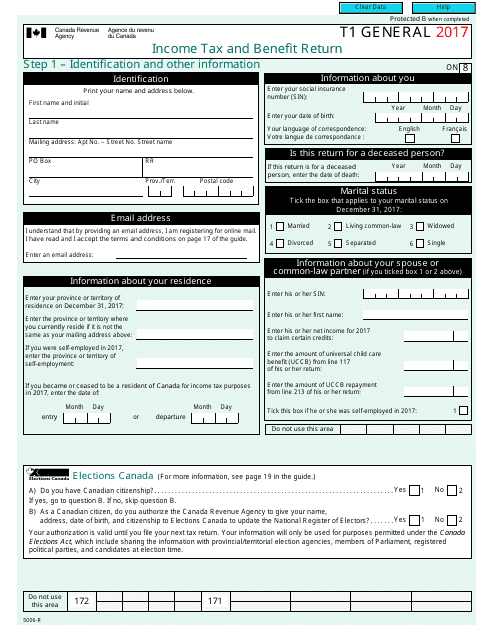

T1 Paper Filing T1 Condensed Taxcycle

T1 Paper Filing T1 Condensed Taxcycle

Each package includes the guide the return and related schedules and the provincial information and forms.

2017 tax return canada. Most income tax and benefit returns for 2017 are due on April 30 2018. If you had dealings with a non-resident trust or corporation in 2017 see Other foreign property in the guide. 2018 Income Tax Package.

File online - There are a variety of software products to meet your needs some of which are free. You cannot use the ReFILE web service to file an amended T1 return for any tax year except 2017 2018 2019 and 2020. Step 2 Total income As a resident of Canada you have to report your income from all sources both inside and outside Canada.

The NETFILE and ReFILE services will be open until Friday January 21 2022. Federal Income Tax Rates for 2017 15 on the first 45916 of taxable income 205 on the next 45915 of taxable income on the portion of taxable income over 45916 up to 91831. 2019 Income Tax Package.

You and if applicable your spouse or commonlaw partner need to do your taxes on time every year to continue getting your benefit payments even if your income is tax exempt or you had no income at all. Search from more than 400 credits and deductions based on your specific situation. A return of an international or non-resident client including deemed residents of Canada newcomers to Canada and individuals who left Canada during the year the elected split-pension amount a return where you have income from a business with a permanent establishment outside your province or territory of residence you have to complete Form T2203 Provincial and Territorial Taxes for Multiple.

You must file your 2017 tax returns by the deadline set by the Canada Revenue Agency and Revenu Québec. For 2017 the EI rate is dropping to 163 per cent from 188 per cent for the past four years of insurable earnings up to a 2017 earnings maximum of 51300. Let us walk you through it step by step.

File online with confidence with Canadas 1 tax software. Tax packages for all years. Each year people who are Canadian residents for tax purposes complete an income tax return.

2016 General Income Tax and Benefit Package. For Quebec employees the maximum employee premium for 2017 is 65151. This is Canada Revenue Agency CRA certified Netfile software 2017 needed to file tax return for year 2016 in Canada.

Your tax return is securely submitted directly to the CRA with just one click. Sign in securely to HR Block Canadas 2017 do-it-yourself online tax software. Sale and address on your tax return when you sell your principal residence to claim the full principal residence exemption.

Get your 2017 past taxes done right. Simply select the year that you need to complete your taxes and well show you which version you need to file a previous years tax return. The maximum employee premium for 2017 will be 83619.

TurboTax 2019 2018 2017 2016 or 2015. If yes complete Form T1135 and attach it to your return. For the 2020 tax year prior to filing your tax return electronically with.

Software is listed in alphabetic order. Simple income tax calculator published on this site can be used to calculate approximate taxes you need to pay but you must use certified software to file your tax return to CRA. Foreign workers employed in Canada under the Seasonal Agricultural Workers Program who are non-residents or deemed non-residents.

2017 General Income Tax and Benefit Package. Individuals can select the link for their place of residence as of December 31 2017 to get the forms and information needed to file a General income tax and benefit return for 2017. You do not have to pay tax on any capital gain when you sell your house if it was your principal residence for all the years.

Filing online is fast easy and secure. TurboTax CDDownload software is the easy choice for preparing and filing prior-year tax returns online. Find more tax credits.

Reporting the sale of your principal residence Starting with the 2016 tax year you are required to report basic information date of acquisition proceeds of disposition eg. ARCHIVED - 5006-R T1 General 2017 - Income Tax and Benefit Return - Version for Ontario ON only We have archived this page and will not be updating it. In addition you cannot file a return electronically in any of the following situations.

For more information about online filing go to Get ready to file your 2017 income tax return. Prepare file previous years income tax returns online with TurboTax. You can use it for research or reference.

Each package includes the guide the return related schedules and the provincial or territorial schedules information and forms except Quebec. Fast easy accurate to prepare and file your income tax return. The NETFILE and ReFILE services are now open for the electronic filing of your 2017 2018 2019 and 2020 T1 personal income tax and benefit return.

2020 Income Tax Package. Canadas 1 Tax Software.