So for example if the YMPE for a given year is 50000 and you. Your CPP disability payment amount is based on your CPP contribution history plus a fixed payment.

The information is required to calculate your CPP benefit as described in How to Calculate Your CPP Retirement Pension written by Doug Runchey for the retirehappyca website.

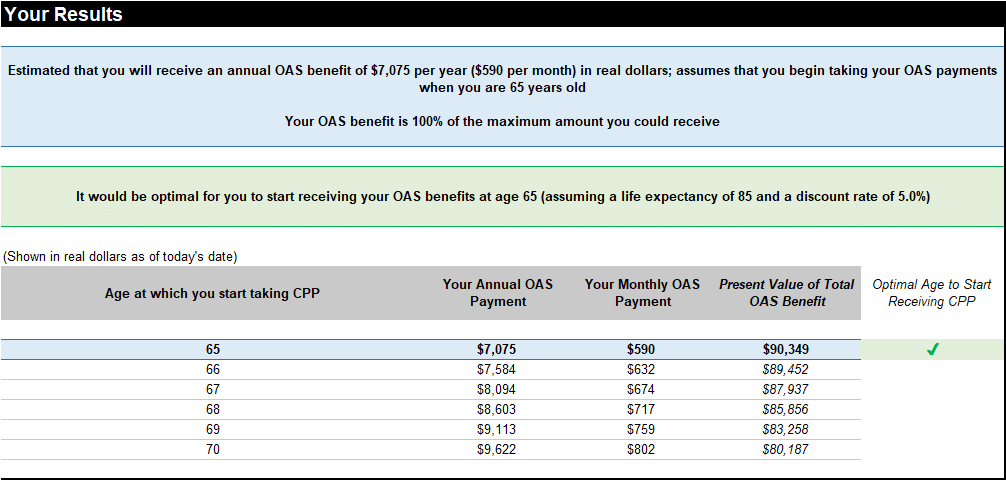

How to calculate your cpp benefit. For a 65 year old the. The table also provides a list of the annual escalation factors that are used once a benefit is in pay. To calculate your CPP retirement pension the first thing you should do is go online to the My Service Canada site and obtain your most recent CPP Statement of Contributions SOC.

With the information from your CPP statement of earnings you can use this Government of Canada retirement income calculator to get a rough idea of your future CPP entitlement. Take 2 minutes to get your results. Getting those calculations for every age from.

Everyones payment amount is different. The current CPP contribution rate is 495 of your salary and is split between you and your employer to a maximum yearly CPP contribution of 254430. It will also help you estimate your monthly CPPQPP income.

Ages 60 and 65 for 50. This estimate does not include the effects of the child rearing drop-out CRDO. This estimate is based on your average earnings since age 18 and assumes that your earnings will continue at this level until age 65.

The maximum CPP contribution is 316645 for the employees and employers. The estimate will show how much you could receive if you start CPP at the age of 60 the earliest you can apply 65 or 70. Also on the My Service Canada site you can request an estimate of your CPP benefits.

This includes the Old Age Security OAS pension and Canada Pension Plan CPP retirement benefits. Also on the My Service Canada site you can request an estimate of your CPP benefits. These estimates are very accurate if youll be eligible for your CPP retirement.

Created in 1966 the CPP is an earnings-based defined benefit plan that guarantees a fixed percentage of employment earnings below a maximum cap averaged over your working life and payable in retirement starting. A brief primer on the Canada Pension Plan for those of you who like so so many Canadians dont spend hours at a time lurking around government websites for fun. In 2021 the maximum CPP payout is 120375 per month for new beneficiaries.

These amounts increase each year for inflation. To calculate your retirement benefit each year of past earnings is calculated as a fraction of the YMPE in effect for that year. To receive the maximum CPP payment you need to have contributed the max CPP contribution each year for many years.

The Canadian Retirement Income Calculator will provide you with retirement income information. The earlier you start the less you will receive. The calculation of a monthly PRB is determined by the formula.

For 2019 the average CPP disability payment is 100115 per month and the maximum CPP disability benefit anyone can get is 136230. This calculator will help you understand the factors that can affect your Canada Pension Plan CPP or Quebec Pension Plan QPP. As an example he will estimate your CPP benefits including the child-rearing adjustment with two optional start dates eg.

For self-employed people the maximum CPP is 633290. This amount is adjusted if your regular CPP pension started in that year. To calculate your CPP retirement pension the first thing you should do is go online to the My Service Canada site and obtain your most recent CPP Statement of Contributions SOC.

To estimate your retirement incomes from various sources you will need to work through a series of modules. Canadian Retirement Income Calculator. The calculator uses your estimated monthly CPP benefit at age 65 provided to you by Service Canada.

A The amount of your CPP pensionable earnings salary or self-employed earnings for the year.

Only the four 4 years preceding the date of your application are taken into account. 366 days leap year 2013.

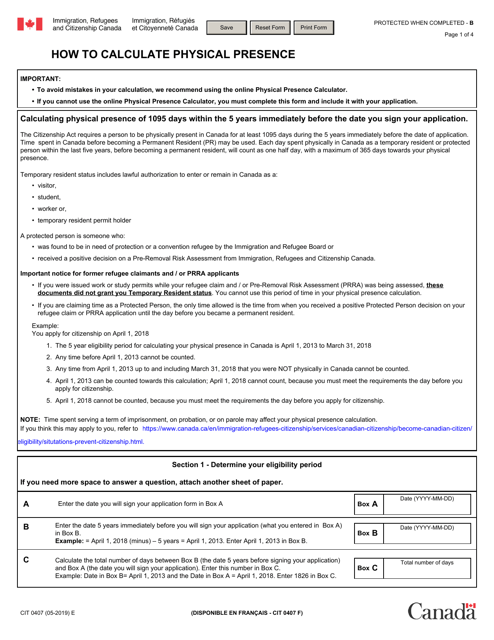

Form Cit0407 Download Fillable Pdf Or Fill Online How To Calculate Physical Presence Canada Templateroller

Form Cit0407 Download Fillable Pdf Or Fill Online How To Calculate Physical Presence Canada Templateroller

You spend 366 days in Canada in 2016 a leap year.

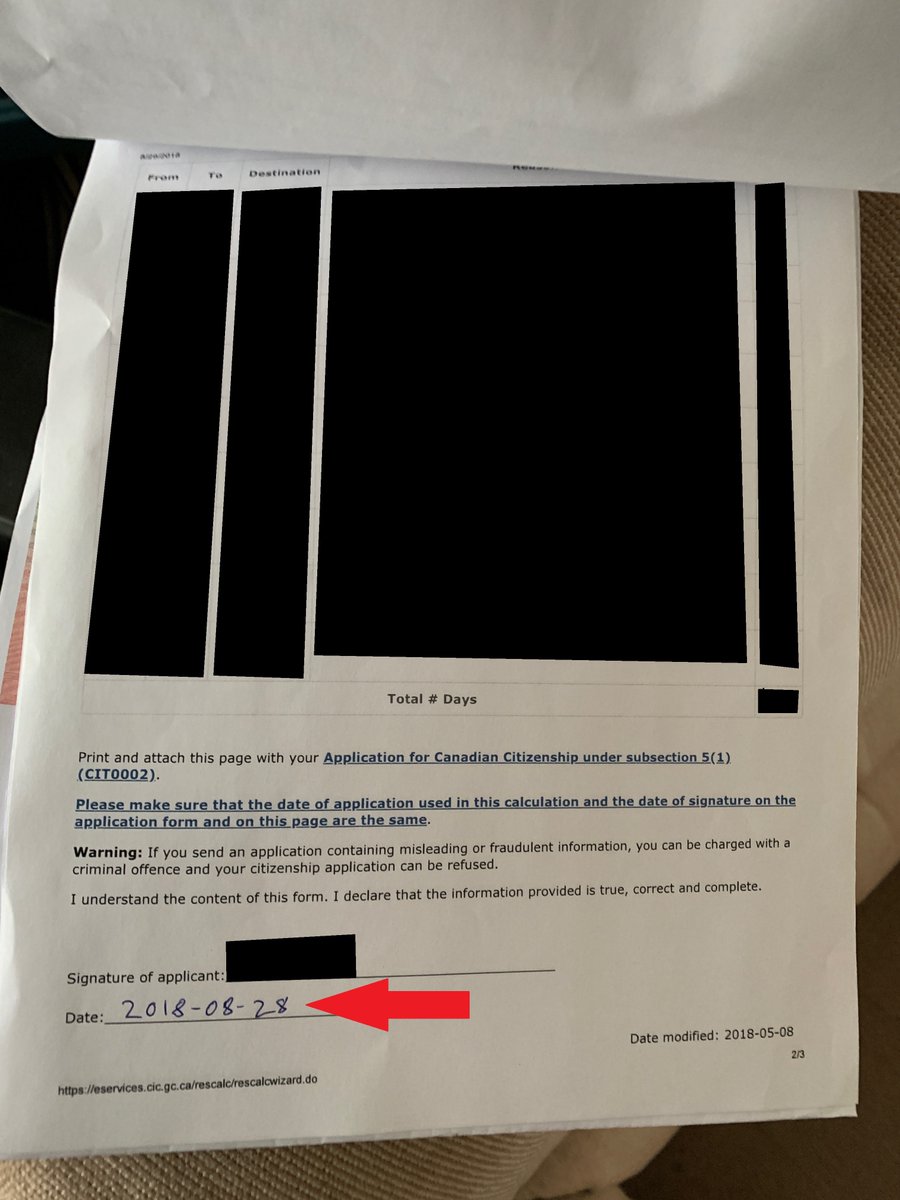

How to calculate citizenship days for canada. Complete and submit the CIT 0177 Residence Outside Canada form when you apply. For example if you sign your citizenship application on November 1st 2020 you must have spent 1095 days in Canada between November 1st 2015 You can calculate your time spent living in Canada using the Government of Canadas physical presence calculator for citizenship. Once you complete all forms and answer all the questions then you will receive your result based on the responses you gave.

Within that four-year period. This helps you calculate how many days youve been in Canada your physical presence in Canada. Use the online physical presence calculator.

Applicants for Canadian citizenship must first obtain permanent status. How is the residence requirement for citizenship calculated. Section 5 of the Act requires that a permanent resident who applies for citizenship must have been physically present in Canada for at least.

You must live in Canada for three 3 years 1095 days within the four 4 years 1460 day s immediately before applying for citizenship. This equals 175 days in Canada in 2013 365 days - 190 days 175 days in Canada in 2013. You must have been physically present in Canada for at least 1460 days four years out of the last six years.

If you spend more than a quarter of the year out of Canada every year for your job there is no way that you can meet the physical presence requirement as you would continually have less than the 3 out of 4 years. Please note that without living in Canada for a minimum of 2 years as a permanent resident you will not meet the residence requirements for citizenship. Dec 23 2020 Use the Physical Presence Calculator to confirm youve been in Canada for the required 1095 days in the past 5 years.

The travel journal is an easy way to record your time outside Canada. Form CIT 0047 must be included as supporting evidence as part of the CIT 0002E Citizenship application. 821 days 57 days absent 764 total days physically present in Canada as a permanent resident Physical Presence 365 764 1129 days physical presence.

To be eligible for Canadian citizenship you must have been physically present in Canada for at least 1095 days in the five years immediately before the date of your application. Form CIT 0407 is a worksheet that is used to calculate the physical presence in Canada. We encourage applicants to apply with more than the minimum requirement of 1095 days of physical presence to account for any miscalculations of absences or any other aspect that could lower the physical.

Canadian citizenship calculator enables you to find out if you have been physically present in Canada long enough to be qualified for citizenship application. Well decide if we can count the time you lived outside Canada. Every day you spent in Canada as a permanent resident counts as a full day.

This calculator allows you to gauge when you may be eligible to apply for Canadian citizenship under the new laws. Get the application Citizenship of Canada Residence Calculator Before you apply for Canadian Citizenship make sure you have completed at least 3 years 1095 days in Canada out of the 5 years 1825 days. Just fill out the questions to the best of your ability click the Calculate button and find out when you may be eligible to apply for Canadian citizenship.

Use a travel journal to record your trips outside Canada. I 1460 days during the six years immediately before the date of his or her application. You are eligible to.

You spend 55 days in Canada in 2017 and want to apply for citizenship on February 25 2017. If that will be the case for some time you might think about applying without the 1095 days and having a judge rule on your case. To calculate whether you have met the residency requirements for Canadian citizenship you must count each day you spent in Canada after becoming a permanent resident as one full day.

It will help you fill out the physical presence calculator or the Residence Outside Canada form. You spend 365 days in Canada in 2015. Get the travel journal You and some minors if applicable must have been physically in Canada for at least 1095 days 3 years during the 5 years before the date you sign your application.

Every day you spent in Canada as a temporary resident or protected person before you become a permanent resident counts as a half day up to a maximum of 365 days. Number of days in Canada. Canadian Citizenship Requirements 2020.

You spend 365 days in Canada in 2014. And ii 183 days during each of four calendar years that are fully or partially within the six years immediately before the date of his or her application. Before you apply for Canadian Citizenship make sure you have completed at least 3 years 1095 days in Canada out of the 5 years 1825 days.

In this example the applicant has been in Canada as a permanent resident for 1483 days and therefore meets the requirement to be physically present for at least 1460 days in the six years immediately before application. Therefore in order to get the maximum 365 day credit you need to be physically present in Canada as a temporary resident or protected person for. Permanent Residents over the age of 18 must meet the residency requirement to be eligible for Citizenship.