Note Pensioners with an individual net income above 67668 must repay part or all of the maximum Old Age Security pension amount. Dont count on the maximum.

Cpp Payments How Much Will Canada Pension Plan Pay In Retirement

Cpp Payments How Much Will Canada Pension Plan Pay In Retirement

How much you contributed and how long you made contributions.

How much will cpp pay me. As you can see the average CPP retirement pension benefit is 68917 which is just over 57 of. So any significant interruptions in your working life or reductions in your earnings such as long periods of unemployment caregiving part-time work or attending school can reduce your eventual CPPQPP income. The contribution rate on these pensionable earnings is 102 99 for the base or original CPP and 03 for the CPP enhancement which began to be phased in on January 1 2019 the contribution rate is split equally between you and your employer.

The maximum CPP contribution is 316645 for the employees and employers. As of 2019 the Canada Pension Plan is being enhanced over a 7 year phase-in. In addition to your CPP disability payment amount you also get an additional payment for each dependent child.

The amount of your CPP payments depends on two factors. The repayment amounts are normally deducted from their monthly payments before they are issued. Canada Pension Plan CPP benefits can make up a key portion of your income in retirement.

In order to qualify for the maximum Canada Pension Plan you will need to make the maximum CPP contribution over the course of many years. For Canada Pension Plan CPP purposes contributions are not calculated from the first dollar of pensionable earnings. Heres a snapshot of the average and maximum CPP payments for 2021.

The full OAS pension is eliminated when a pensioners net income is 109607 or above. The current maximum annual CPP benefit is 14445. The annual maximum pensionable earnings 61600 for 2021 applies to each job the employee holds with different employers different business numbers.

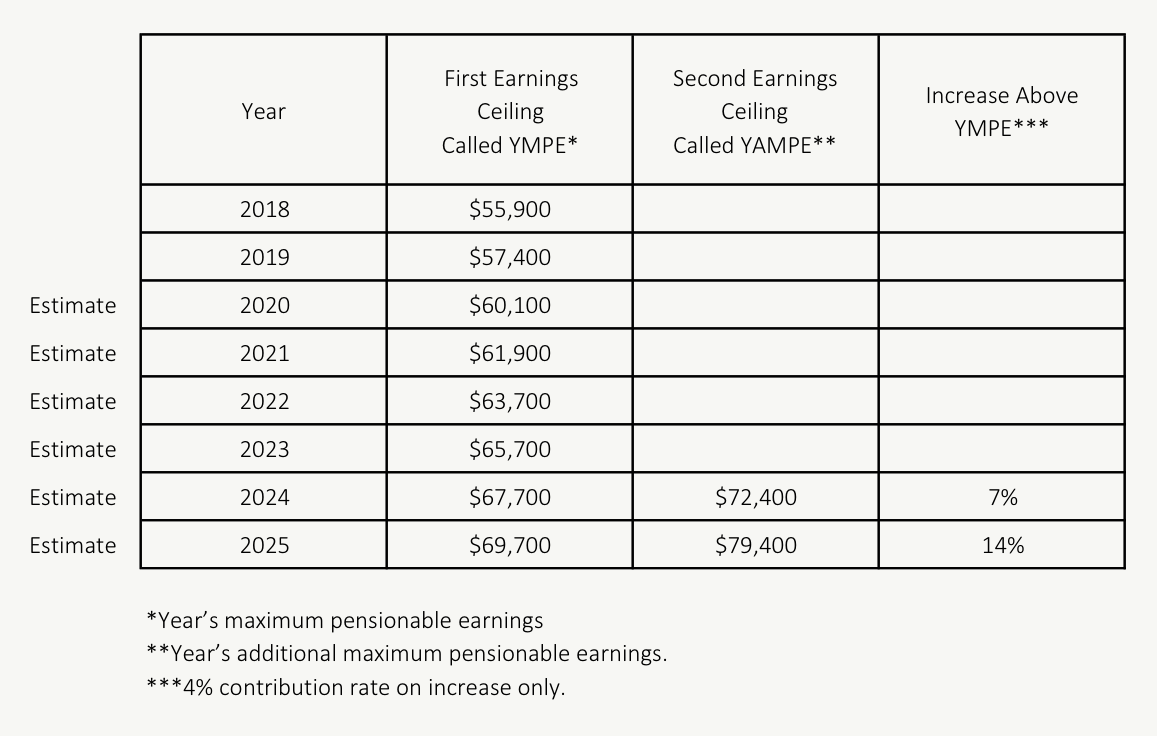

With the enhanced CPP pension amounts are expected to replace 33 of your average pre-retirement income. 13 rows Canada Pension Plan pensions and benefits - Monthly and maximum payment amounts. Each year the Years Maximum Pensionable Earnings YMPe is set by the federal government which forms the basis for both pension and CPP contributions.

The longer you pay into CPPQPP and the more you earn during that time the higher your CPPQPP payments will be when you retire. When planning for retirement the first piece of advice I give is not to plan on getting the maximum. In 2019 the amount per dependent child is 25027.

To receive the maximum CPP payment you need to have contributed the max CPP contribution each year for many years. For 2019 the average CPP disability payment is 100115 per month and the maximum CPP disability benefit anyone can get is 136230. When you look at the average CPP payment its just a little over 640 per month which is a long way from the maximum.

In 2021 the maximum CPP payout is 120375 per month for new beneficiaries. When the new CPP is fully implemented retirees can expect to receive approximately 21000 in todays dollars. Individuals receiving the maximum CPP payments at age 65 can expect to collect more than 14000 per year in benefits.

These amounts increase each year for inflation. The YMPE in 2019 is 57400. For self-employed people the maximum CPP is 633290.

If you are self-employed you pay the full 102. In 2019 the CPP earnings ceiling is 57400. You stop deducting CPP contributions when the employees annual earnings reach the maximum pensionable earnings or the maximum employee contribution for the year 316645 for 2021.

Ad Experience modern global payroll with powerful integrations unified processes. Instead they are calculated using the amount of pensionable earnings minus a basic exemption amount that is based on the period of employment. Ad Experience modern global payroll with powerful integrations unified processes.