Many institutions have changed their policies and will no longer send the remittance stub. Within five minutes you should receive a verification code to the email address you.

Ppt Wsib 101 Powerpoint Presentation Free Download Id 3168087

Ppt Wsib 101 Powerpoint Presentation Free Download Id 3168087

Activer les témoins pour continuer.

Wsib e premium. Have your claim number and personal identification number PIN ready. For online services technical support issues please call 1-888-243-1569 or 416-344-4122 TTY. EClearance Request and maintain Clearance Certificates.

Call us at 1-800-387-0750 if. The WSIB sets an annual maximum for insurable earnings based on the average industrial wage AIW for Ontario. Please do not include the top portion of the premium remittance form or ePremium reporting payment only forms with your cheque.

Injured or ill people. For inquiries regarding your business registration please contact the Employer Service at 416-344-1000 or toll-free 1-800-387-0750 from Monday to Friday between the hours of 730AM to 500PM. Copyright 2021 ePremium Insurance LLC.

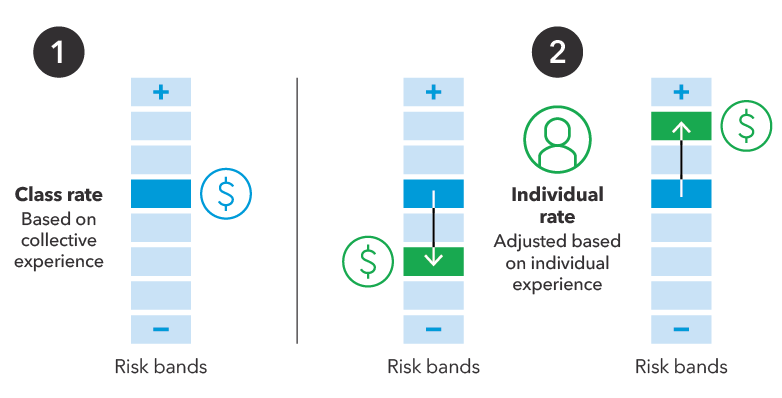

Contact ePremium Insurance Agency LLC. 1-800-387-0050 to reach the HelpDesk line. Your rate is based on the shared risk of all the businesses that do the same type of work in your class and your individual claims history compared to the rest of the businesses in your class.

Ad Search Faster Better Smarter Here. Online or telephone banking through your financial institution. Get workplace health and safety information.

No matter how you choose to pay you still need to report your premiums using our online service for premium reporting or by sending your premium remittance stub to the WSIB before the due date. Report an injury or illness for businesses. 800-319-1390 513-204-1920 Fax 4770 Duke Drive Suite 200.

EPremium Insurance is the gold standard in mandated renters insurance program management for the multifamily housing industry. For online services technical support issues please call 1-888-243-1569 or 416-344-4122 TTY. Find or obtain a clearance.

Thousands of WSIB employers are already using our eWSIB. How to calculate your premium and insurable earnings WSIB wsibca. Les sondages et les services en ligne de la Commission de la sécurité professionnelle et de lassurance contre les accidents du travail WSI.

View insights into your claims costs premiums and rates. EPremium Calculate and report your WSIB premiums based on payroll for one or more WSIB accounts. Report an injury or exposure.

Complete all required fields on the form. EForm 7 Injury and illness reporting for employers. EPremium is the leading provider of integrated risk mitigation solutions to the multifamily housing industry.

View your workplace injury summary report. Report an injury illness or exposure. 1-800-387-0050 to reach the HelpDesk line.

EWISR Get summary. Businesses can log in to. For 2020 the annual insurable earnings maximum is 95400.

Its simple easy and the quickest way we can help you. You must verify your email address by choosing Get verification code before you can Continue. This approach ensures that businesses are paying a rate that is.

See my 2021 rate. This payment is applied to your WSIB account as a credit and will be applied towards your future premiums. It is up to you to ensure the accuracy of the information that you enter.

This online calculator will work with the information that you provide. Mail your cheque to WSIB PO Box 4115 Station A Toronto ON M5W 2V3or drop it off at a WSIB office. Log in to access your claim information online.

The WSIB is funded by the premiums received from Ontario businesses. You will then need to enter the email address you would like to use as your user ID. We have utilized our combined years of industry experience to provide our clients with the best-of-breed solutions for both renters insurance and security deposit alternatives.

See more information about clearances. WSIB has made this online calculator available as a tool that you can use to learn how to estimate and calculate WSIB insurable earnings and premiums. Ad Search Faster Better Smarter Here.

Report and pay premiums.

Of course if earnings are to be reported the employer is required to pay an insurance premium on those earnings that can. Employee and the extent to which such payments are to be treated as insurable earnings for the pur-poses of reporting to the Workplace Safety and Insurance Board WSIB.

If you are closing an account in 2021 the 2021 annual insurable earnings maximum is.

Insurable earnings wsib. For 2020 the annual maximum was 95400. To be considered as insurable earnings an amount has to be. The WSIB Maximum Insurable Earnings Ceiling for 2021 is 102800 compared to 95400 in 2020.

For 2021 the annual insurable earnings maximum is 102800. An estimate of the total annual insurable earnings for sole proprietors partners and executive officers as well as gross insurable earnings for workers Independent Operators must have their contractsinvoices for the current reporting period Your WSIB Premium Remittance Form or the rate group numbers assigned to your WSIB account if available. See this years annual maximum.

As I see it the better way to go about this process is to first find my Insurable Earnings through either the Income Statement or the Employee Detail plug that number into the calculator and then check if the calculated Premium matches the Payable in our books. Employers pay premiums on gross insurable earnings up to the maximum insurable earnings set for the year. That method would verify the accuracy of.

The WSIB will request your earnings information generally for the two years prior to your injury and determine your average weekly earnings. However if your insurable earnings are greater than 300000 you must pay monthly. The WSIB sets an annual maximum for insurable earnings based on the average industrial wage AIW for Ontario.

The WSIB sets an annual maximum for insurable earnings. If in the WSIBs opinion you are not a permanent regular worker your earnings may be adjusted at the 13th week. If your insurable earnings are less than 300000 you can choose to pay annually monthly or quarterly.

Self-employed earnings from a transaction gross income less operating expenses other than capital expenditures that are less than or equal to the maximum yearly insurable earnings. Once an individuals earnings reach the annual maximum you do not need to. The WSIB maximum amount of insurable earnings for that year was 65600.

The frequency of payments you have to make depends on your annual insurable earnings. For 2018 the maximum insurable earnings ceiling is 90300. The WSIB sets an annual maximum for insurable earnings based on the average industrial wage for Ontario.

The Insurable Earnings and Collection of Premiums Regulations IECPR define insurable earnings as the total amount of earnings that a person has from all insurable employment with certain exceptions. Request the amount of insurance that best reflects your annual insurable earnings up to an annual maximum. Changes to the Maximum Insurable Earnings Ceiling are directly linked to changes in average earnings in Ontario as measured by Statistics Canada and provisions under.

The WSIB will verify this amount if you file a claim. The WSIB applies different methods to calculate insurable earnings for drivers in the transportation industry depending on whether the person is a workeremployee ie not working on contract is an owner-operator who the WSIB has ruled to be an independent operator and who has elected WSIB optional insurance. Any earnings above this limit are not subject to WSIB premiums.

Excess earnings for an employee are any earnings above the annual maximum insurable earnings. The difference of 2400 is considered excess. Once an individuals earnings reach the annual maximum you do not need to report the earnings that go above the maximum.

Benefits are based on the amount requested or your actual earnings whichever is lower. The employer is therefore responsible to pay premiums on the workers insurable earnings until the annual maximum of 65600 has been reached.

Classification scheme and data sources. WSIB freezes premium rates for Ontario businesses.

Wage for Ontario from the most recent published Statistics Canada earnings data available on July 1 2019.

Wsib ontario rates. WSIB Freezes Premium Rates for Ontario Businesses. Premiums and payment FAQs. Changes to the Maximum Insurable Earnings Ceiling are directly linked to changes in average earnings in Ontario as measured by Statistics Canada and provisions under.

Mill Products and Forestry Services. Pulp Newsprint and Specialty. This means that 607-million can stay in the provinces businesses instead of going to the government.

The WSIB will cut 2020 premiums by an average of 17. If a business includes electrical and HVAC repairs with 70 of payroll going to HVAC staff and 30 of payroll going to electrical staff the 2019 rate group rates will be weighted 7030 to create a single starting group rate. The WSIB provides the following example of what it means for a rate to be weighted by payroll.

How to calculate your premium and insurable earnings. How to calculate your premium and insurable earnings. 2017 lost-time injury rate was 095 and continues to be the lowest amongst all jurisdictions in Canada.

The WSIB Maximum Insurable Earnings Ceiling for 2021 is 102800 compared to 95400 in 2020. The WSIB Maximum Insurable Earnings Ceiling for 2019 is 92600 compared to 90300 in 2018. DCN-JOC News Services October 1 2020.

Rates from past years. TORONTO Ontarios Workplace Safety and Insurance Board WSIB announced today that premium rates for Ontario businesses will be frozen at the same levels paid in 2020. Schedule 2 employers are employers that self-insure the provisions of benefits under the WSIA.

Since 2010 the number of people covered by the WSIB for Schedule 1 firms has increased by approximately 24 per cent while the lost-time injury rate and no lost-time injury rate have both decreased by 15 percent and 14 per cent respectively. Rates from past years. Great news for business owners in Ontario.

Workplaces people and claims Since 2008 the services health care manufacturing transportation and construction sectors accounted for over 80 per cent of both WSIB covered employment and allowed lost-time claims. Veneers Plywood and Wood Preservation. 35 rows The WSIB Maximum Insurable Earnings Ceiling for 2020 is 95400 compared to 92600 in 2019.

Schedule 1 employers are those for which the WSIB is liable to pay benefit compensation for workers claims. How to report and pay your premiums. The WSIB is funded solely by premium revenue.

All businesses will continue to pay the same rate they did in 2020. 35 rows The WSIB Maximum Insurable Earnings Ceiling for 2020 is 95400 compared. The Workplace Safety and Insurance Board WSIB announced on October 1 2020 that premium rates for Ontario businesses will be held for another year at the same levels paid in 2020 offering stability as employers grapple with the economic impact of the global pandemic.

How to report and pay your premiums. Schedule 1 employers are required by legislation to pay premiums to the WSIB and are protected by a system of collective liability. Changes to the Maximum Insurable Earnings Ceiling are directly linked to changes in average earnings in Ontario as measured by Statistics Canada and provisions under the Workplace Safety and Insurance Act.

This is positive news for businesses who may have been concerned about a potential rate increase and gives businesses across Ontario more opportunity to adjust to the ongoing pandemic. In 2019 employment covered by the WSIB for Schedule 1 and Schedule 2 firms increased by 3 per cent compared. 1 2020 CNW - The Workplace Safety and Insurance Board WSIB announced today that premium rates for Ontario businesses will be held for another year at the same levels paid in.

Big News for WSIB rates. Premiums and payment FAQs. The WSIB recently announced that premium rates will not change for 2021.

The WSIB is funded solely by premium revenue. Changes to the Maximum Insurable Earnings Ceiling are directly linked to changes in average earnings in Ontario as measured by Statistics Canada and provisions under the Workplace Safety and Insurance Act. The announcement comes after four years of decreases that cut the average premium rate.

The WSIB annual maximum insurable earnings for 2020 is 95400 an increase of three per cent over the 2019 ceiling of 92600.