Travel at least 80 km one way for medical services. Travel Medical Insurance premium costs are eligible for the CRA Medical Expense Tax Credit along with other eligible uninsured medical expenses you incur while you are travelling outside Canada.

How To Claim Medical Travel Expenses

How To Claim Medical Travel Expenses

If you are using the simplified method you can use our meals and mileage calculator to determine the amount out your allowable travel medical expenses.

Cra travel medical expenses. You can claim medical expenses on line 33099 or line 33199 of your tax return under Step 5 Federal tax. On September 3 2020 CRA announced that effective January 1 2020 the rates allowable under the simplified method related to travel for medical expenses moving expenses and the northern residents deduction as well as meal claims for transport employees increased to 23 from 17 per meal for a total of 69dayThis is also the amount that CRA has stated is reasonable for a meal and. 2007-0229901E5 discusses the eligibility of medical travel insurance premiums for purposes of the medical expense credit.

You only need to enter on this page the medical expenses that you havent entered anywhere else on your return. The following CRA document should help. If the medical treatment youre traveling to receive is performed outside of Canada you can claim the amounts you paid to a medical practitioner and those paid to a public or licensed private hospital.

Some of the most common are the travelling costs to and from treatment especially chemotherapy or other cancer-related therapy Watson said. If you travelled over 80 kilometres you can also claim the accommodation meals and your own vehicle expenses including parking charges. Other commonly missed medical expenses include the following.

Your spouse or common-law partner. This guide is for people with medical expenses. Medical expenses are claimable in the best 12-month period ending in the tax year.

Can you claim the disability amount. It contains a list of the eligible medical expenses. Line 33099 You can claim the total eligible medical expenses you or your spouse or common-law partner paid for any of the following persons.

Claiming Medical Travel Expenses After the busy tax season with most tax returns being filed the Canada Revenue Agency CRA gets busy to make sure that items that people have claimed on their tax return are valid. If you had to travel to obtain medical expense you may be able to claim certain travel expenses as medical expenses. Form T2201 or a medical practitioner must certify in writing that the person is and in the foreseeable future will continue to be dependent on others for his or her personal needs and care because of a lack of normal mental capacity.

Also to help you organize your receipts see my article titled Organize your Medical Receipts Reduce Your Tax Preparation Fee. Be aware that youll need to meet certain criteria to receive this tax credit and the credit is not available for other types of travel insurance. For example if you drove 10000 km during the year and half of that was related to your move you can claim half of the total vehicle expenses on your tax return.

These amounts must be reduced by 3 of net income. 1 - Fees paid for full-time care in a nursing home under paragraph 11822d. As most returns are e-filed the tax department does not get any supporting documents to validate any claims made.

You can view this. When in doubt contact the Canada Revenue Agency for clarification or visit the Canada Revenue Agency Web page discussing medical costs. A number of eligible medical expense tax credits are overlooked every year such as medical travel expenses according to Ronald Watson a chartered accountant in Fort Erie.

Do not enter any medical expense amounts that youve already entered in box 85 of your T4 page or box 135 of your T4A page. The CRA allows you to claim transit expenses taxi bus or train if you travel over 40 kilometres for medical treatment. Fortunately Canadian travellers may be eligible to recoup some of the cost of your travel medical insurance premium by claiming it for a CRA Medical Expense Tax Credit on your income tax return.

Publications listed by number - CRA. Common expenses that qualify as medical expenses are listed below. The travel costs can be calculated by keeping all receipts or by using the CRA meal expense allowance and vehicle cost per kilometre amounts.

So it often makes sense to claim medical expenses on the return of the spouse with the lower taxable income so long as taxes are payable. HR Blocks tax software will automatically claim these amounts for you on your return. Travel expenses at least 40 km the cost of the public transportation expenses for example taxis bus or train when a person needs to travel at least 40 kilometres one way but less than 80 km from.

Your claim for vehicle expenses is the percentage of your total vehicle expenses that relate to the kilometres driven for moving or medical expenses or for northern residents deductions. Reasonable travel expenses meals lodging vehicle expenses including parking may also be claimed. Travel expenses less than 40 km travel expenses cannot be claimed as a medical expense if you traveled less than 40 kilometres one way from your home to get medical services.

The CRA allows you to claim reasonable transportation and travel costs for a companion but only if your doctor has certified in writing that your condition makes you unable to travel by yourself. RC4065 Medical Expenses - 2020. Medical expenses for travel.

The eligibility for a credit medical expenses are not available as a deduction are contained in s11822q as you mentioned. Medical Expense Tax Credits allow you to reduce your income tax liability by claiming travel medical insurance premiums and other eligible medical expenses on your tax return and meeting certain. It contains a list of the eligible medical expenses.

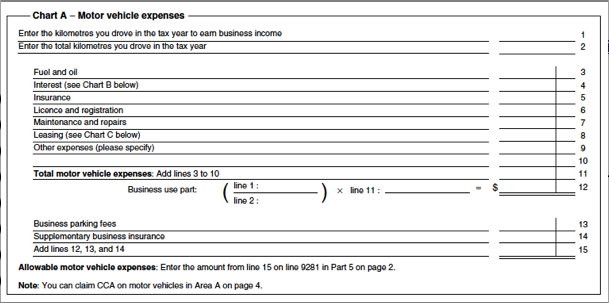

However if you use your life insurance policy as collateral for a loan related to your business including a fishing business you may be able to deduct a limited part of the premiums you paid. If you are filing your Canadian income tax as a sole proprietor or partner using the T1 tax return when you are filling out Form T2125 Statement of Business or Professional Activities you will be listing various business expenses.

Cra Form T2125 Everything You Need To Know Bench Accounting

Cra Form T2125 Everything You Need To Know Bench Accounting

A business can claim only half the CCA allowable for some assets in the year of purchase.

Business expenses cra. In a previous blog Gabrielle Loren founding partner of Loren Nancke Chartered Professional Accountants explained the importance of tracking your business mileage. CRA requires an annual information return to be filed stating all payments made to construction subcontractors. The Canada Revenue Agency CRA allows you to deduct expenses for the business use of your home if it is your main place of business or if you use the space to earn your business income.

A taxable benefit for their cost. The CRA has a list of the common business expenses that you can deduct. The CRA defines business expenses as a cost you incur for the sole purpose of earning business income Typical expenditures include money spent on buying inventory to sell or the costs associated using your personal car for business reasons.

These telephone expenses may include a home phone if the company office is located in the home. Computer and other equipment leasing costs. For example if in the current tax year you purchased some applications software for your business you would be.

All of your claimed business expenses on your income tax return need to be supported with original documents such as receipts. CRA agreed these meals were legitimate business expenses and did not assess CL. The CRA allows business owners to claim a reasonable portion of their vehicle expenses back as a tax deduction.

You have to support business expense claims with a sales invoice an agreement of purchase and sale a receipt or some other voucher that supports the expenditure. This can be applied to most expenses relating to a vehicle. But these expenses must involve repairs not improvements.

Common Business Expenses The CRAs business expenses index lists many common business expensesfrom accounting to utilitiesand explains the income tax deductions rules relating to each expense. Deduction of Business Expenses Indirect Tax Audit Techniques Absent a specific statutory provision to the contrary expenses incurred for the purpose of earning income from business or property are deductible for tax purposes. This is commonly referred to as the half-year rule.

Generally all businesses can deduct from their income expenses that are incurred not only to make the business operational but also to maintain that business once it is up and running. In most cases you cannot deduct your life insurance premiums. Without the evidence from receipts for your claimed business expenses the Canada Revenue Agency CRA may decide to.

Business tax fees licenses and dues. The general rule is that you cannot deduct outlays or expenses that arent related to earning business income. Accounting and legal fees.

If you pay cash for any business expenses be sure to get receipts or other vouchers. The following may be considered when determining operating expenses. If your business depends on delivery vehicles fuel and repairs are legitimate expenses as are maintenance costs for a building.

Telephone expense paid on phone and fax lines for a business space and used specifically for business purposes are fully deductible. If you buy something for both personal and business reasons you may deduct the business portion of the expense. The cost of a personal computer is not deductible if you use it to play computer games.

The Canada Revenue Agency CRA defines a deductible business expense as any reasonable current expense you paid or will have to pay to earn business income. You cannot deduct purely personal expenses as business expenses. A business expense is a cost you incur for the sole purpose of earning business income.

Some of the most common deductible expenses include motor vehicle and meals and entertainment expenses. CRA Business Expenses Need a Reasonable Expectation of Profit. The insurance costs related to business use of workspace in your home have to be claimed as business-use-of-home expenses.

The issue more often than not is convincing a CRA tax auditor that an expense was in fact incurred by the business. Also indicated that the corporation also paid for meals for his helpers but since his corporation had neither employees nor formal subcontractors CRA considered those meals a taxable benefit. The Canada Revenue Agency CRA allows you to claim only 50 percent for Meals and Entertainment where these would be classified.

If your business expenses exceed your business income you will record a business loss on this form. Heres how to claim business use of home expenses in Canada on your taxes. If so you can deduct the percentage of the lease costs that reasonably relates to earning your business incomeYou can also deduct the percentage of airtime expenses for a cellular telephone that reasonably relates to earning your self-employment income.

Interest and bank charges.

Entertainment expenses include tickets and entrance fees to an entertainment or sporting event gratuities cover charges and room rentals such as hospitality suites. In some cases meals and entertainment expenses can be 100 deductible The Income Tax Act generally restricts the deduction for food beverages and entertainment expenses to 50 of the amount actually paid to earn income.

What Can Independent Contractors Deduct

Lets take a look at the portion of the interpretation bulletin that a CRA auditor will use to disallow your meal expenses.

Entertainment expenses cra. Tickets for a concert entertaining guests at sporting events etc. Travel meal and entertainment costs. Meals and entertainment expenses are frequently flagged for audit by the CRA and they can be very difficult to substantiate after the fact.

Many of us are familiar with the rules that if you incur meals entertainment expenses for the purpose of earning business or property income you can claim 50 of the expenses against income subject to certain requirements and a few exceptions. Expenses you can deduct include those for food beverages tickets and entrance fees to entertainment or sporting events. Meals and entertainment expenses For any outlay for entertainment to qualify as a deductible expense a taxpayer must be prepared to demonstrate that the amount was incurred for the purpose of earning income.

You can claim 100 of your food and entertainment expenses when. All such expenses including tips and taxes should be carefully documented because theyre subject to the 50 ruleAccording to CRA Entertainment expenses include tickets and entrance fees to an entertainment or sporting event gratuities cover charges and. E tax treatment of travel and entertainment.

What qualifies as meals and entertainment. However its important that the amount charged for meals and beverages be clearly itemized on bills from the golf club. In addition the cost of a restaurant gift certificate is considered to be an expense for food or.

The 50 limitation applies to the cost of food or beverages for human consumption including any related expenses such as taxes and tips. There are several exceptions where a taxpayer is permitted to claim 100 of the expenditure. For more information go to Interpretation Bulletin IT-518 Food Beverages and Entertainment Expenses.

While the gen-eral rule in the Income Tax Act is that expenses incurred to earn a pro t are deductible in the computation of business income in practice the tax rules are seldom that straightforward. You can deduct part of the cost of entertaining clients. Meals and entertainment are provided to participants but no amount of the fee is allocated or identified for those services.

You bill your client or customer for the meal and entertainment costs and show these costs on the bill. You include the amount of the meal and entertainment expenses in an employees income. As a result subsection 671 3 deems 150 to be paid or payable for food beverages and entertainment 50 per day and to be subject to the 50 limitation.

Canada Revenue Agencys CRA information on meals and entertainment expenses for sole proprietorships and partnerships explains allowable meal deductions which can be claimed without keeping receipts for self-employed foot and bicycle couriers and rickshaw drivers for the cost of the extra food and beverages they must consume in a normal working day 8 hours because of the nature of. Meals include food and beverages. However meal and beverage expenses consumed at a golf club are 50 tax deductible as with any other meal or entertainment expense.

Entertainment expenses Commission employee expenses. If its entertainment its not deductible Entertainment is a general term that the IRS says is entertainment amusement or recreation such as entertaining at night clubs cocktail lounges theaters country clubs golf and athletic clubs sporting events and on hunting fishing vacation and similar trips including such activity relating solely to the taxpayer or the. What are Entertainment Expenses.

Meals and entertainment expenses for fishers. Fortunately most clubs understand and automatically do this. You can also deduct tips cover charges room rentals to provide entertainment such as hospitality suites and the.

Entertainment expenses include tickets and entrance fees to an entertainment or sporting event gratuities cover charges and room rentals such as for hospitality suites. Excerpt CRA IT-518R - Food Beverages and Entertainment Expenses April 16 1996 Food and Beverages 17. Entertainment includes attendance at an event eg.

For more information go to Interpretation Bulletin IT-518 Food Beverages and Entertainment Expenses.