Proposed GSTHST rules on e-commerce supplies. Cross-border digital products and services.

Gst Hst Quick Method Simplicity And Savings

Gst Hst Quick Method Simplicity And Savings

14 rows GSTHST rates.

Gst/hst rates. However to calculate the amount of GSTHST payable multiply the revenue from your supplies including the GSTHST for the reporting period by the quick method remittance rate or rates that apply to your situation. When HST was first implemented the GST for Canada was 7. Below is a summary of the standard and reduced VAT Values Added Tax and GST Goods Sales Tax rates across the world 2021 VAT and GST rate changes Find out the main 2021 VAT and GST rate changes announced from around the world.

This is combined in most Provinces with the local PST which are set between 5 and 9 to create a Harmonised Sales Tax HST rate. See below for an overview of sales tax amounts for each province and territory. As of July 1 2016 the HST rate increased from 13 to 15.

The Value Added Tax in Canada is referred to as a Goods and Sales Tax on the federal level and is a rate of 5. Tax rate for all canadian remain the same as in 2016. As of July 1 2016 the HST rate increased from 13 to 15.

In fact the last increase in HST was for Prince Edward Island a raise of 1 on october 1 st 2016 see the article. In recent years some provincial governments have remodelled their provincial sales taxes PST to combine the administration of the PST with the GST in order to create a Harmonized Sales Tax HST. The GST applies nationally.

Province On or after October 1 2016 July 1 2016 to September. However government has exempted healthcare and educational services from the purview of the GST. If you are domiciled in an HST-participating province you will collect sales tax at the following rates.

PST GST and HST. The simplified GSTHST rate for purchases is calculated as follows. Canadian GST PST and QST rates Canadian Federal GST is charged at 5.

When you use the GSTHST quick method for your business you still charge the applicable GST and HST on your supplies of taxable goods and services. GST and HST rates by province. As of July 1 2019 the PST rate was reduced from 8 to 7.

For example - 5105 times 245689 including GST 11699 GST paid. GSTHST Rates Across Canada. Some examples of GSTHST exempt goods and services are.

There are three types of sales taxes in Canada. For payments starting July 2021 income levels are based on your 2019 income. GST rates on services comprising of 5 12 18 and 28 comes with various pros and cons for the consumers.

Income Where You Stop Receiving Any GSTHST Credit Payments. Short-term accommodation through digital. Some provinces like Ontario New Brunswick Newfoundland and Labrador Prince Edward Island and Nova Scotia have incorporated the federal GST into their provincial sales tax regime to form the Harmonized Sales Tax HST.

Goods supplied through Canadian fulfillment warehouses. Many provinces also charge a provincial sales tax either separately as a PST or as part of the combined Harmonized Sales Tax HST. Every province except Alberta has implemented either a provincial sales tax or the Harmonized Sales.

This has resulted in confusion on which sales tax rates apply. The HST is in effect in Ontario New Brunswick Newfoundland and Labrador Nova Scotia and Prince Edward Island. With eCommerce more and more businesses are selling goods and services across Canada.

The Goods and Services Tax council has. Current HST GST and PST rates table of 2021 On March 23 2017 the Saskatchewan PST as raised from 5 to 6. The HST includes the provincial portion of the sales tax but is administered by the Canada Revenue Agency CRA and is applied under the same legislation as the GST.

Used residential housing GSTHST is only charged on new or substantially renovated residential housing. The GST is a federal tax levied on goods and services purchased in Canada. HST rates differ in each province since its a combination of the 5 GST throughout all of Canada and the different PST rates for each province or territory.

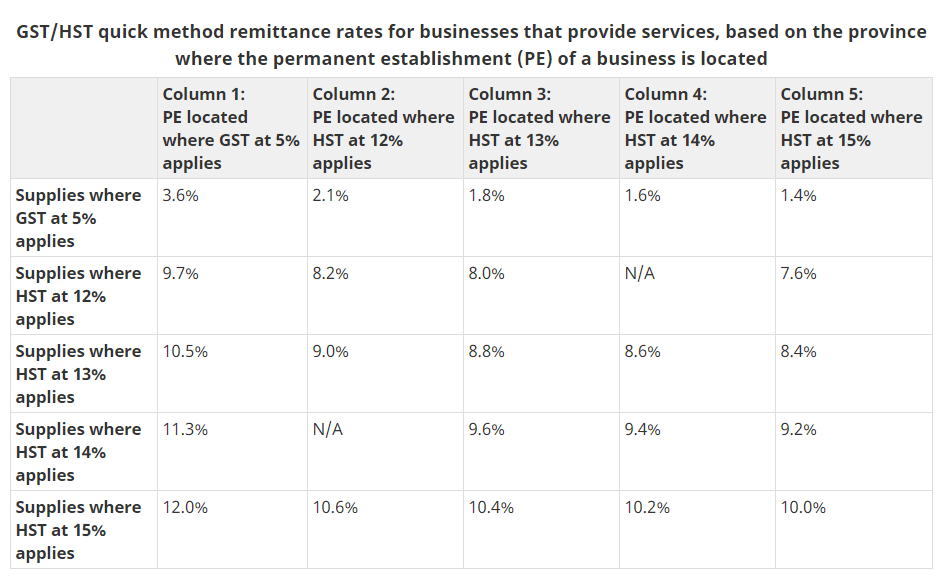

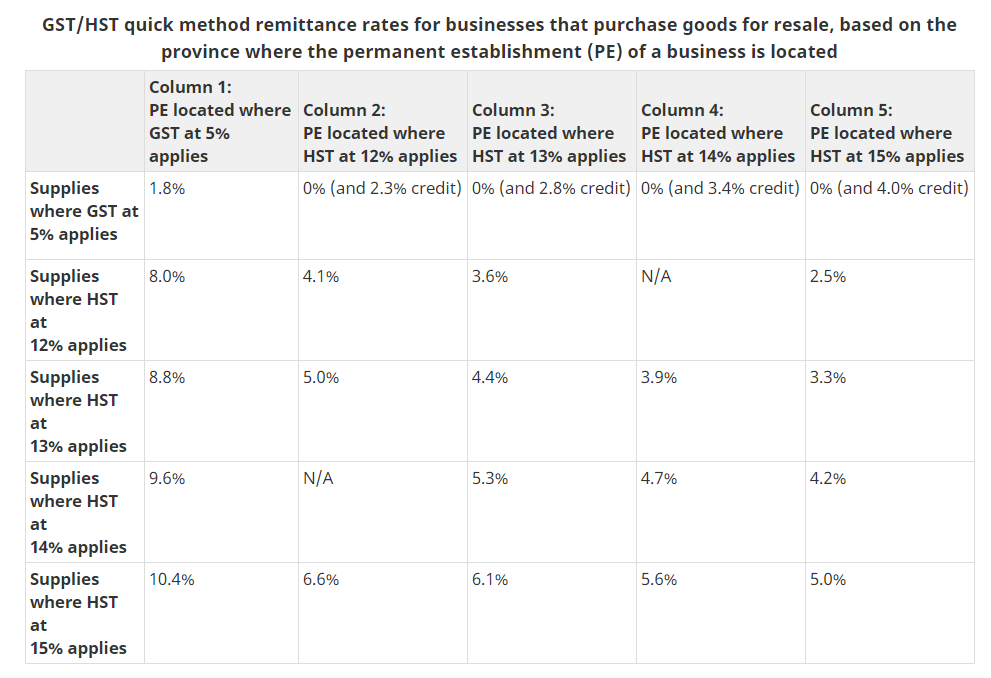

Depending on the province your business operates in the rates. The GSTHST consequences surrounding any transaction depend on the unique circumstances of each case. For GST 5 the simplified tax rate would be 5105 times total purchase amount including GST GST paid ITC.

Here is a breakdown of the tax rates. The GSTHST Self-Assessment Rules Place of Supply The HST rates depend on the place of supply. HST applies at the rate of 13 in Ontario New Brunswick and Newfoundland and Labrador 15 in Nova Scotia and 12 in British Columbia.

For example if your business resides in Ontario but you are shipping goods to Manitoba rather than charging the Ontario rate of 13 HST on the sale you would charge 5 GST and 7 Manitoba. There is the provision to pay quarterly installments for businesses on Annual Returns. Majority of Canadian businesses must collect sales taxes from customers and remit them to the government.

HST was first introduced in Canada in 1997 in the provinces of Newfoundland Labrador Nova Scotia and New Brunswick. HST combines PST with GST to create one tax this means that if youre applying for HST you dont have to apply for GST too. In Canada the Goods and Services Tax GST is the federal tax added on to most commercial sales.

You must charge either HST or GSTPST according to the destination provincialterritorial rates. Current GSTHST rate 100 Current GSTHST rate Simplified rate. His GSTHST credit entitlement of 451 is given in four quarterly payments of 11275 on the payment dates.

Be aware that if you dont file your taxes you wont receive your GSTHST credit. Why do they vary. Substantial renovations are defined as the removal or replacement of most of the building except for the roof walls foundation and floors - see the CRAs B-092 Substantial Renovations and the GSTHST New.

The GST is 5 and HST including GST is as follows. The proposed GSTHST rules would take effect on July 1 2021 and generally apply when a foreign business sells to consumers in Canada including.