Consumers will not pay the tax directly to the federal government. A starting levy of Can20 US15 per tonne of pollution imposed on Manitoba New Brunswick Ontario and Saskatchewanall led by Conservativeswill add about 44 cents to.

Carbon Tax Canada Transportation Cost Impacts On April 1

Carbon Tax Canada Transportation Cost Impacts On April 1

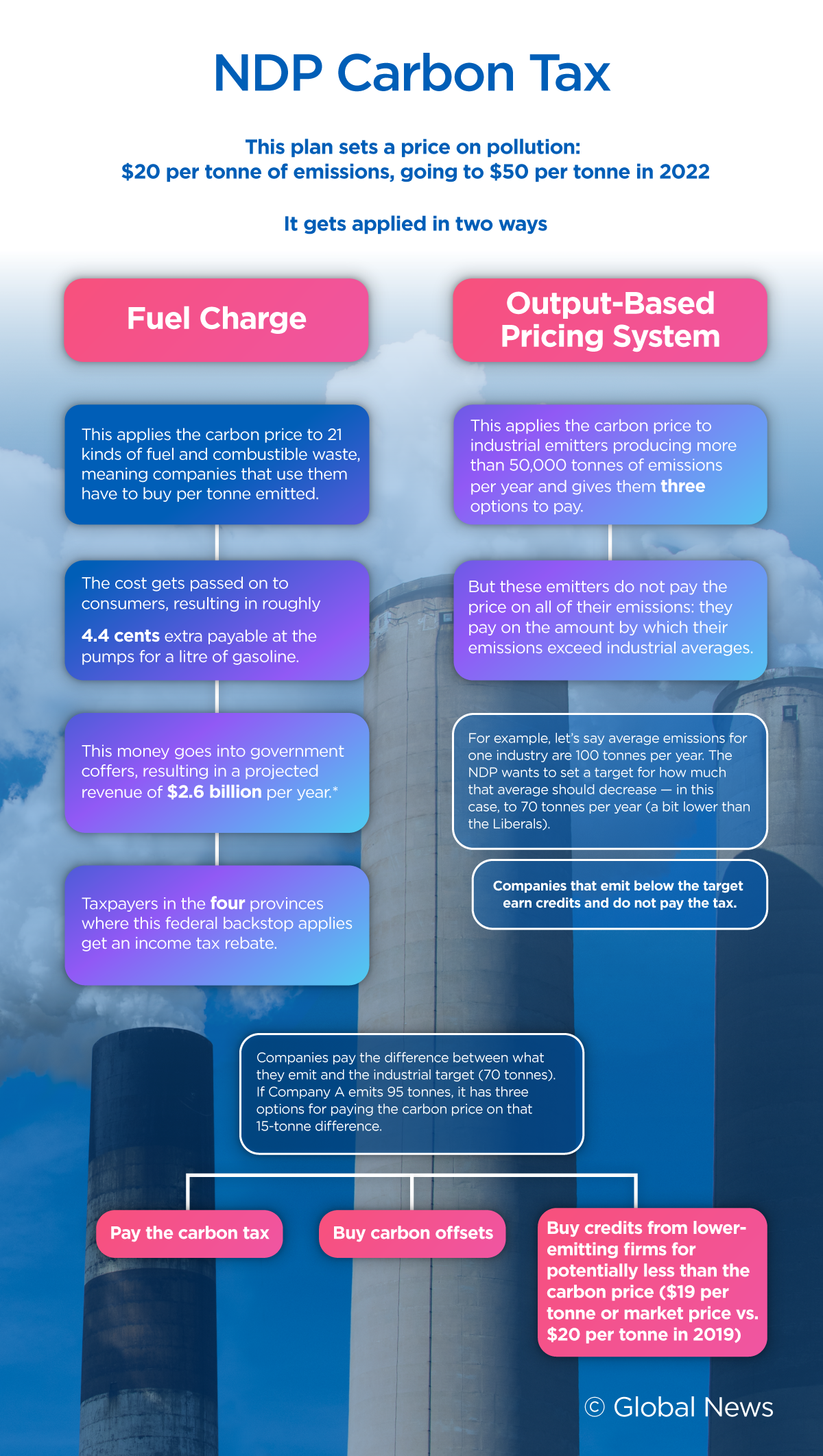

Justin Trudeau JustinTrudeau October 23 2018 The federal carbon pollution price will start low at 20 per ton in 2019 rising at 10 per ton per year until reaching 50 per ton in 2022.

Canada carbon tax 2019. This can be applied either as a tax on goods produced or sold or as carbon permits that corporations can trade on a regional market well get into the. The tax will increase annually reaching 50 per. Rather Ottawa will impose the tax on fuel and production and distribution companies which will in turn pass on those costs to.

Based on province a family of four could receive up to 600 in 2019. Canada has imposed a landmark carbon tax on four provinces which had defied Ottawas push to combat climate change prompting unhappy premiers to. In 2019 the carbon price starts at 20 per tonne of carbon dioxide released.

1 on April 1 2019 and in Nunavut and Yukon on July 1 2019. Quebecs scheme was introduced in 2013. The Canadian Trucking Alliance CTA estimates that the surcharge will add C3500 the annual costs to operate a long-haul truck per year.

Rising carbon tax. That translates to an additional 44 cents per litre of gasoline. The surcharges will eventually increase to C0134 per liter by 2022 or C32 billion industrywide.

How much you may receive depends on your province of residence and your personal situation. Change your income tax and benefit return to claim the CAI payment even after you filed. Initially set at Can20 US16 per tonne of emissions the carbon pricing schemewhich applies to a range of fuels and sources of CO 2 emissionsis to incrementally rise to.

Whether or not the cap on equalization should be lifted is an ongoing debate in Canada. In April Prime Minister Justin Trudeau will impose a 14-per-ton carbon tax now called a price on pollution for branding purposes on any province not already levying one this includes. Canadas Climate Action Revenue Incentive Program is a new initiative to combat climate change.

It began to apply in Alberta on January 1 2020. Residents in rural areas will receive 10 more than residents who live in cities. Six years later the rate increased to 35 and as of 1 April 2019 the provinces carbon tax is 40 per tonne.

These provinces and territories are known as To make sure your business is up-to-date on the fuel charge use our Get registered for the New CRA Fuel Charge. The federal carbon tax began in Ontario New Brunswick Saskatchewan and Manitoba on April 1 2019 because those provinces did not create their own plans in. Last modified on Mon 1 Apr 2019 1845 EDT.

Claim your Carbon Tax Rebate when you file your Income Tax return. For example for 2020 a family of four could receive 888 in Alberta 809 in Saskatchewan 486 in Manitoba and 448 in Ontario. Quebec and Ontario opted for a cap-and-trade approach to pricing carbon.

Alberta has had a carbon tax on large greenhouse gas emitters for more than a decade. Kenneys United Conservative government campaigned and won the 2019 election around a centrepiece promise to scrap the Alberta NDP consumer carbon tax which brought in 2 billion a year most of it returned in rebates with the rest used for green initiatives.

Here S Where The Federal Parties Stand On The Carbon Tax National Globalnews Ca

Here S Where The Federal Parties Stand On The Carbon Tax National Globalnews Ca

1 2017 and rose to 30 per tonne on Jan.

Alberta ndp carbon tax. After all the CBCs report on Saturday of what. At the beginning of 2017 Albertas NDP government implemented a 20 per tonne tax on carbon dioxide emissions from burning fossil fuels used for transportation and heating. The United Conservative government repealed that not long after forming government.

According to the Government of Canada the average Alberta household will receive an 880 rebate at the end of the first 15 months of the carbon. The Alberta governments website says the carbon tax should only cost directly on average 286 for single people 388 for couples and 508 for couples with two children. Albertas carbon levy jumped from 20 per tonne to 30 per tonne on Monday which Hoffman says will mean an extra two-and-a-half cents per litre at the gas pumps.

Fuel sellers are expected to comply with the changes set out in the Bill. Alberta had its own consumer carbon tax under Notley when she was premier. Deputy premier Sarah Hoffman told reporters there was a clear link between the approval of several pipelines last year and the tax that Alberta first introduced on.

Bill 1 An Act to Repeal the Carbon Tax received Royal Assent on June 4 2019The carbon levy no longer applies to any type of fuel effective as of the beginning of the day on May 30 2019. Alberta Opposition NDP Leader Rachel Notley said Kenney has wasted precious time by not having an Alberta-friendly Plan B ready to go. In the lead up to Albertas provincial election in April the United Conservative Party campaigned on a promise to kill the carbon tax put in place by the previous NDP government in.

But that doesnt count. The United Conservative Party says the NDP hid the Alberta carbon tax from Albertans in the 2015 election. NDP Leader Rachel Notley said Kenneys decision to fight the federal carbon tax caused two years of damage to Albertas reputation with global investors Instead of getting Albertans back to.

The revenue would be used. Posted on December 17 2019 139 am. He said all options remained on the table choosing not to rule out Alberta implementing its own carbon tax in lieu of the federal one as the previous NDP government had done.

1 2017 the Alberta NDP government under Rachel Notley enacted its carbon tax beginning at 20 per tonne of carbon dioxide emissions and rising to. The tax was set at 20 per tonne of carbon dioxide emissions as of Jan. Albertas carbon tax jumped on New Years Day but the provinces NDP government maintains the tax played a vital role in Albertas improving economic outlook.

The NDP government implemented a 20 per tonne carbon tax on Jan. Emily Mertz breaks down the claim and has response from both parties and an. EDMONTON Albertas carbon tax jumped on New Years Day but the provinces NDP government maintains the tax played a vital role in Albertas improving economic outlook.

Kenney said today two-thirds of Albertans continue to oppose a carbon tax. The linked weekend revelations that the NDPs carbon tax had no meaningful negative impact on Albertas economy and that 40 per cent of Albertans received carbon-tax rebates larger than the tax they paid were ill timed from the governments perspective. Repeal of carbon levy.

A couple of years later in December 2020 Prime Minister Trudeau revealed the Canadian federal government would be raising the carbon emissions tax in provinces that did not already create their own emissions reduction. WATCH ABOVE December 2020.

Carbon Tax Canada Transportation Cost Impacts On April 1

Carbon Tax Canada Transportation Cost Impacts On April 1

Canadas carbon tax increasing April 1 despite coronavirus economic crunch - National Globalnewsca Carbon tax rising from 20 per tonne to 30 per.

Carbon tax ontario. Ad Get Carbon Tax With Fast And Free Shipping For Many Items On eBay. The current 30 per tonne carbon levy is to rise to 170 per tonne in 2030 with hopes it will encourage Canadians to reduce greenhouse gas emissions that contribute to climate change. The federal carbon pollution pricing system will be implemented in Ontario under the federal Greenhouse Gas Pollution Pricing Act with the following features.

We apologize but. Change your income tax and benefit return to claim the CAI payment even after you filed. Ad Get Carbon Tax With Fast And Free Shipping For Many Items On eBay.

Thats because the carbon tax is scheduled to increase by 33 on April 1 up from its current level of 30 per tonne of industrial greenhouse gas emissions to 40 per tonne. In Ontario Manitoba New Brunswick and Saskatchewan where conservative-minded governments have steadfastly opposed any sort of carbon pricing scheme Ottawa will apply its carbon tax. Ever since Justin Trudeau introduced his carbon tax in 2019 the Prime Minister and his environment ministers have been dining out on their claim 80 of families will be better off financially.

How much is Canadas carbon price. In the wake of that March 25 decision Campaign. Ad Search For Relevant Info Results.

Get Results from 6 Engines. For larger industrial facilities an output-based pricing system for emissions-intensive trade-exposed EITE industries will start applying in. Looking For Great Deals On Carbon Tax.

Looking For Great Deals On Carbon Tax. From Everything To The Very Thing. The federal carbon tax began in Ontario New Brunswick Saskatchewan and Manitoba on April 1 2019 because those provinces did not create their own plans in time for the federal deadline.

Ad Search For Relevant Info Results. How much you may receive depends on your province of residence and your personal situation. The findings come after Ontario Alberta and Saskatchewan lost their Supreme Court challenge against Ottawas carbon tax last month.

Get Results from 6 Engines. For example for 2020 a family of four could receive 888 in Alberta 809 in Saskatchewan 486 in Manitoba and 448 in Ontario. Ontario residents evenly divided on support for carbon tax poll finds - Flipboard.

For consumers the federal minimum price started at 20 per tonne of CO2 equivalent in 2019. As of this April its 40 rising to 50 in 2022 and increasing. The new tax plan was met with some resistance from Canadian provinces like Ontario Saskatchewan Manitoba and New Brunswick.

From Everything To The Very Thing. Ontario Premier Doug Ford reacted on Friday to Prime Minister Justin Trudeaus announcement that his administration would increase the carbon tax until it.

And Alberta saw increases in emissions. The price of diesel will increase by about C0054 per liter or about C020 per gallon a Canadian dollar currently is valued at US075 in Ontario Saskatchewan New Brunswick and Manitoba.

Https Www Mdpi Com 2071 1050 11 22 6280 Pdf

Wynne Premier Kathleen Wynne is leaving the door open to a new tax to combat climate change just months after saying a carbon tax was not part of the Ontario.

Ontario carbon tax 2017. And whereas a carbon tax doesnt recognize the sequestration and positive impact of agriculture the cap and trade approach which Ontario has taken potentially allows for farms to receive credits to offset costs. OTTAWA -- Many Ontarians received an automated text message over the weekend asking if they agree that the carbon tax must be scrapped. Single parents also get that amount for their first child.

Although the government has warned homeowners to expect an extra 5 on natural gas bills Enbridge for example says its carbon fee will be in the range. Carbon tax is payable in foreign currency at the rate of US003 3 cents per litre of petroleum and diesel products or 5 of the cost insurance and freight value as defined in the Customs and Excise Act Chapter 2302 whichever is greater. Under the federal system the estimated average cost impact for a household in Ontario is 244 in 2019 which is less than the average for Climate Action Incentive payments 300.

Albertas carbon tax is 20t of carbon dioxide in 2017 while permits in Ontarios cap and trade system currently trade at about 18t of carbon dioxide. 56 for each child in the family starting with the second child for single parents A family of four will receive 451. In Manitoba the government has said it will implement a carbon tax.

The federal government mandated the charge in those provinces because their governments did not implement a carbon-pricing scheme. The second adult in a couple gets 77. Ontario could see carbon tax.

Theres 38 for each child in. These broad based tax measures amount to 103 billion the same amount carbon revenues would bring in. Learn the basics of cap and trade Effective July 3 2018 we cancelled the cap and trade regulation and prohibited all trading of emission allowances.

We have developed a plan to wind down the program. Ontario CaT 2017 - 2018 Alberta carbon tax 2017 Chile carbon tax 2017 Colombia carbon tax 2017 Massachusetts ETS 2018 Argentina carbon tax 2018 Canada federal OBPS 2019 Singapore carbon tax 2019 Nova Scotia CaT 2019 Saskatchewan OBPS 2019 Newfoundland and Labrador carbon tax 2019. How much you may receive depends on your province of residence and your personal situation.

Ontarios small business tax rate will be cut from 35 to 25. Four provinces had a carbon price in 2017 British Columbia and Alberta had a direct carbon tax and Ontario and Quebec had cap-and-trade systems. Whos behind the campaign and what they plan to.

A single adult or the first adult in a couple gets 154. What you need to know about Ontarios carbon market using a cap and trade program including how it works and who is required to participate. For example for 2020 a family of four could receive 888 in Alberta 809 in Saskatchewan 486 in Manitoba and 448 in Ontario.

Estimated annual costs We know from experience in British Columbia Alberta and Quebec that provinces with a price on carbon pollution in 2017 were the fastest-growing economies in Canada. Looking west Alberta legislators have opted to present their constituents with a straightforward carbon levy instead beginning at 101 per gigajoule of natural gas in January 2017 then jumping to nearly 152GJ in January 2018 and have promised to reinvest 645 million of the collected revenue in energy efficiency and micro-generation initiatives over the next five years. Change your income tax and benefit return to claim the CAI payment even after you filed.

Alberta will maintain a 30-per-tonne carbon tax on large industrial facilities to align the new governments plan with the federal climate law and stave off possible intervention from Ottawa. Ad BlogsBunny rank blog and news content to ensure writers get the recognition they deserve.

Here S What We Know And Don T Know About Alberta S Carbon Tax

Here S What We Know And Don T Know About Alberta S Carbon Tax

The Alberta Carbon Tax is a federally imposed program that puts a price on carbon emissions in Alberta.

Alberta new carbon tax. Ad Over 80 New. Made-in-Alberta carbon tax poised to return but no details yet 19 hours ago Its a start but farm groups and governments eye bigger changes to AgriStability 2 days ago Giving credit where its due. The 127 largest emitters such as oilsands plants or.

From January 1st 2020 onwards Alberta is going to be under the Federal Carbon Tax which follows the same premise. While I dont like the federal carbon tax the truth is that it is in one sense at least less costly to Albertans than the Alberta NDP carbon tax he said. The tax started at 20 per ton in 2019 and will rise 10 per ton each year until reaching 50 per ton in 2022.

This is set to increase to over 22 billion once the tax reaches 50 per tonne in 2022 and to over. Ad BlogsBunny rank blog and news content to ensure writers get the recognition they deserve. This Is The New eBay.

That was partly designed to squeeze money out of taxpayers to spend on NDP pet projects like subsidizing low-flow shower heads and light bulbs. That is set to extend to over 22 billion as soon as the tax reaches 50 per tonne in 2022 and to over 28 billion by 2023. The new plan introduced in the Alberta legislature Tuesday puts large industrial emitters under two regulatory regimes.

For 2021-22 carbon tax revenues in Alberta underneath the federal coverage will exceed 18 billion. Albertas new carbon tax Posted on 31 December 2015 by Andy Skuce On Sunday November 22nd 2015 Albertas new centre-left Premier Rachel Notley announced that the province would be introducing an economy-wide carbon tax priced at 30 per tonne of. Find Carbon Tax Now.

New front opens in carbon tax debate March 19 2021 More Articles. For 2021-22 carbon tax revenues in Alberta under the federal policy will exceed 18 billion. Ad Over 80 New.

This Is The New eBay. We rank content to ensure you receive only the best news and blog content. In December of last year Prime Minister Justin Trudeau said.

According to the Government of Canada the average Alberta household will receive an 880 rebate at the end of the first 15 months of the carbon tax if they claim it. Alberta reports 1100 new cases of COVID-19 for second day in row highest positivity rate since January Residents of El Mirador given eviction notices building to be demolished Political Ads. Find Carbon Tax Now.

The financial fiscal and political advantages of taking again management of the carbon tax are substantial. We rank content to ensure you receive only the best news and blog content. Albertas new UCP government will continue to apply a 30-per-tonne carbon price that covers the majority of greenhouse gas emissions in the province but will loosen the rules so that some of the.

Kenneys claim carbon tax damaged Alberta economy is refuted in court documents The new federal carbon levy will start at 20 per tonne increasing to 30 per tonne in April and 50 per tonne by. Before the federal carbon tax the province had the Alberta Carbon Levy which was repealed through Bill 1 an act to cancel the provincial carbon tax on June 4 2019.