Normally these would be federal. The source deductions you have to withhold and remit to the CRA may be any combination of.

Pd7a Statement Of Account For Current Source Deductions Canada Ca

Pd7a Statement Of Account For Current Source Deductions Canada Ca

Saras total tax deduction is 6695 4270 2425.

Source deductions ontario. The Ontario income thresholds personal amounts surtax thresholds and tax reduction amounts have been indexed for 2021. Source deductions are deductions taken off your paycheque from the source of the income - ie your employer. Salary commission or pension.

1 Information about the employee or beneficiary please print Last name First name. What source deductions do you have to withhold and remit. Employment insurance EI premiums.

Employers must remit these deductions to the Canada Revenue Agency CRA in addition to their portion of the Canada Pension Plan and Employment Insurance contributions. You first need to enter basic information about the type of payments you make. Be sure to read the Instructions section before completing the form.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Source deductions permitted only for purposes listed in Section 36 of the Labour Standards Code including deductions for. As the employer you withhold a portion of your employees salary plus you contribute 14 times that amount and remit the total to Revenue Canada.

297000 11 27000. For more information on Source Deductions please read and understand the Employment Standards legislation. A payroll deductions online calculator lets you calculate federal provincial and territorial payroll deductions for all provinces and territories except Quebec.

Once retired the Ontario government will award you with a monthly amount of money to subsidize your loss of income. There are several ways help calculate how much and which deductions are taken from each employee. You then have to remit these deductions to the Canada Revenue Agency CRA.

Since months are counted only once their AMWA is calculated as follows. In terms of how CPP is deducted from your paycheck each week as the employee 45 is deducted from your earnings and the employer matches that contribution dollar for dollar. The tool then asks.

Calculating EI Rates for Employee Source Deductions Revenue Canadas Employment Insurance EI rates change on January 1 st of each year. You assume the risks associated with using this calculator. It will confirm the deductions you include on your official statement of earnings.

This publication is the Payroll Deductions Tables for Ontario effective January 1 2021. Find out your due dates and how often you have to pay remit make a payment and confirm your payment was received. Companies X and Y are associated corporations.

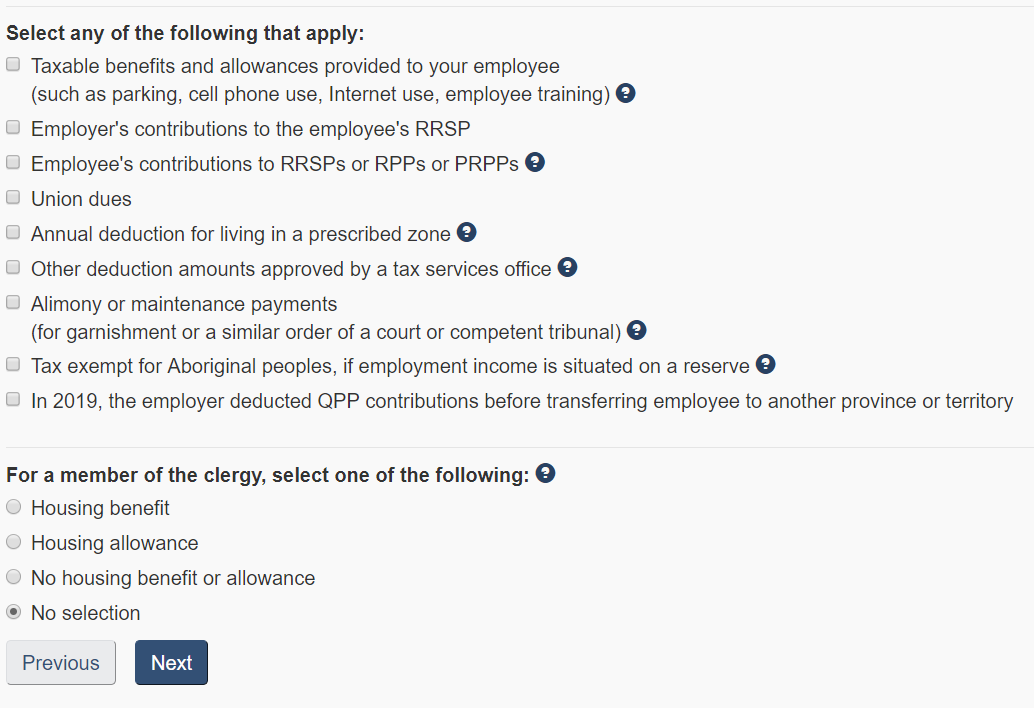

This amount of taxes will be included in your remittance to us. Canada Pension Plan CPP contributions. Source Deductions Return 2019 You must give this form duly completed to your employer or payer so that the income tax to be withheld from the amounts paid to you can be determined.

It reflects some income tax changes recently announced which if enacted by the applicable legislature as proposed would be effective January 1 2021. The following deductions should be sent to the Federal Government. Canada Revenue Agencys document T4127 Payroll Deductions Formulas for Computer Programs - Effective January 1st 2018 Revenu Québecs document TP-1015F-V Formulas to Calculate Source Deductions and Contributions - Effective January 1st 2018.

Federal provincial or territorial income tax. How and when to pay remit source deductions. You may also be required to make other payroll deductions such.

Payroll Deductions Tables You can download guides T4008 Payroll Deductions Supplementary Tables and T4032 Payroll Deductions Tables from our webpage at canadacapayroll. Income tax CPP EI and other amounts required by federal or provincial law or by court order or judgment An overpayment of wages Group benefit plans that the. Each corporation had to remit for January through November.

How to use a Payroll Online Deductions Calculator. Canada Pension Plan contributions. In 2017 their combined source deductions remittances were 297000.

In the Ontario tax deductions table the provincial tax deduction for 615 weekly under claim code 1 is 2425.