The components of the Normalized Cash Flow calculation. The payment is included in Normalized EBITDA as described in note 14.

Emuaid Defeats Severe Lichen Sclerosus and Improves Appearance within Hours.

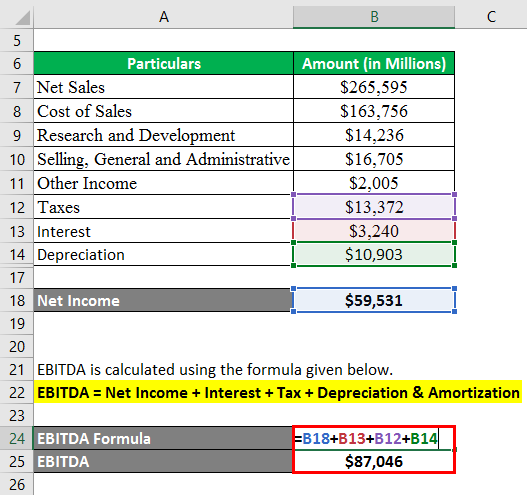

Normalized ebitda calculation. Start by calculating earnings before income taxes depreciation and amortization ie. Adjusted or normalized EBITDA is one of the components in determining a companys valuation as well as establishing debt financing and its various loan covenants. Firstly identify the minimum and maximum value in the data set and they are denoted by x minimum and x maximum.

EBITDA or - adjustments to EBITDA - Capital Expenditure or - change in the cash component of Net Working Capital. EBITDA was 140 million or -78 million 141 million - 1 million 78 million net interest. Enterprise Value market capitalization value of debt minority interest preferred shares cash and cash equivalents EBITDA Earnings Before Tax Interest Depreciation Amortization.

The equation of calculation of normalization can be derived by using the following simple four steps. When you start the EBITDA Calculation you use Net Income which would include the deductions for depreciation interest and business insurance premiums. The formula used by experienced business transfer professionals in the Micro Market to calculate NCF is.

NRFA connects adoptee families with embryo donors. Ad Get more information about an alternative to expensive IVF treatments. Normalized EBITDA is calculated as operating revenues base bareboat revenue less operating expenses plus profit sharing plus DPO.

To this figure add back interest expense income taxes. Plus or Less adjustments to. EBITDA Multiple Enterprise Value EBITDA.

To Determine the Enterprise Value and EBITDA. How to Calculate EBITDA. The components of the Normalized Cash Flow calculation.

Once Adjusted EBITDA is established through a quality of earnings analysis it becomes the baseline for future performance measurement incentives and compliance calculations of the business. Net income includes expenses of interest taxation and depreciation amortization. Since income tax was originally a credit of 1 million.

To get to EBITDA you would take Net Income and then add back depreciation expense interest expense and Taxes and Amortization. EBITDA which begins with a companys net income. The problems with EBITDA stem from its starting point Net Income which fails to capture the true profitability of a firm.

The first quarter DPO payment was received subsequent to the quarter and is therefore not reflected in the accounts. Net Income Net Interest Expense Provision for Income Taxes Depreciation and Amortization EBITDA. Ad Emuaid Gave Me My Life Back I Am So Thankful For This Amazing Product.

Ad Get more information about an alternative to expensive IVF treatments. Some of the more common being described below. Ad Emuaid Gave Me My Life Back I Am So Thankful For This Amazing Product.

Calculate standard EBITDA first using the net income from the companys income statement. The formula to calculate EBITDA is below. NRFA connects adoptee families with embryo donors.

Emuaid Defeats Severe Lichen Sclerosus and Improves Appearance within Hours. The formula used by experienced business transfer professionals to calculate Normalized Cash Flow is. EBITDA is the approximate measure of a companys operating cash flow based on the companys financial statements before charging interest income taxes depreciation and amortization plus all other normalizing adjustments.

EBITDA then ignores the real cost of capital needed to maintain a business through its. How to Calculate Adjusted EBITDA.