For several years fraudulent emails claiming to be from the Canada Revenue Agency have been targeting Canadian taxpayers. Beware of Scam Emails from the Canada Revenue Agency Around this time every year scammers start sending out emails to Canadians claiming to be from the Canada Revenue Agency.

Cra Income Tax Phishing Scam Still Going Strong Police Warn Globalnews Ca

Cra Income Tax Phishing Scam Still Going Strong Police Warn Globalnews Ca

Scammers pretending to be Canada Revenue Agency CRA employees often contact Canadians to trick them into paying fake debts.

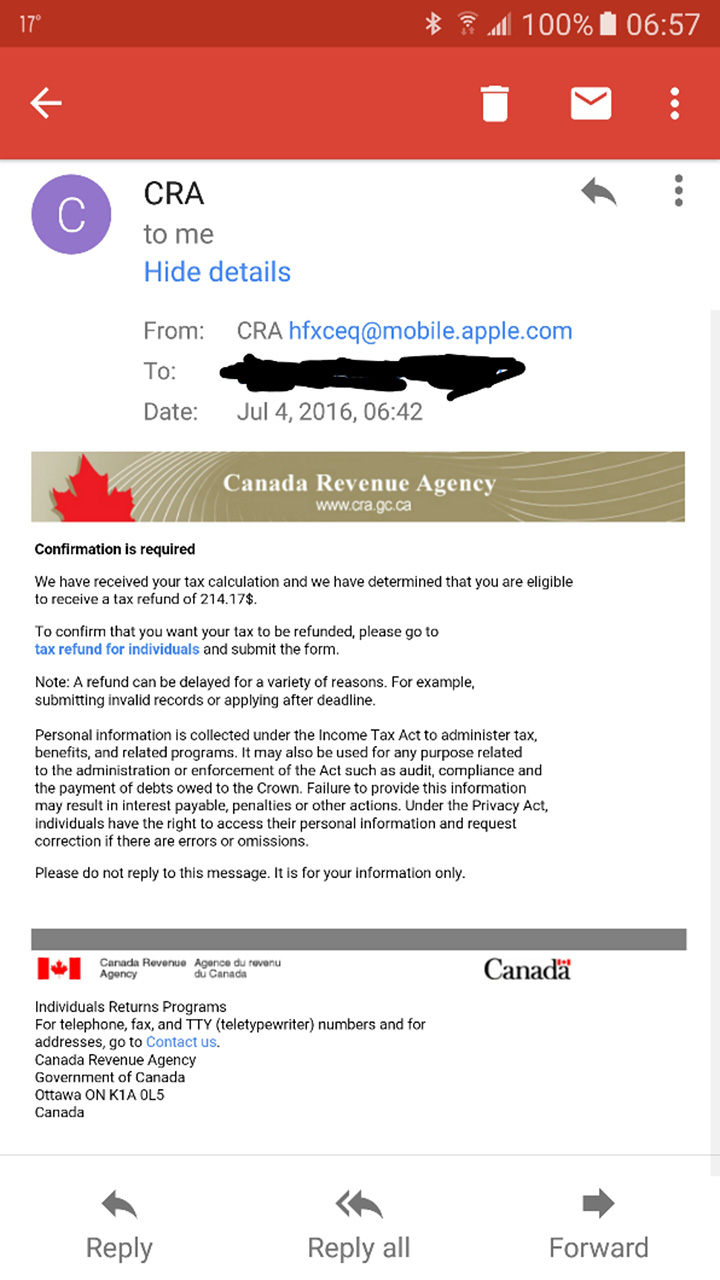

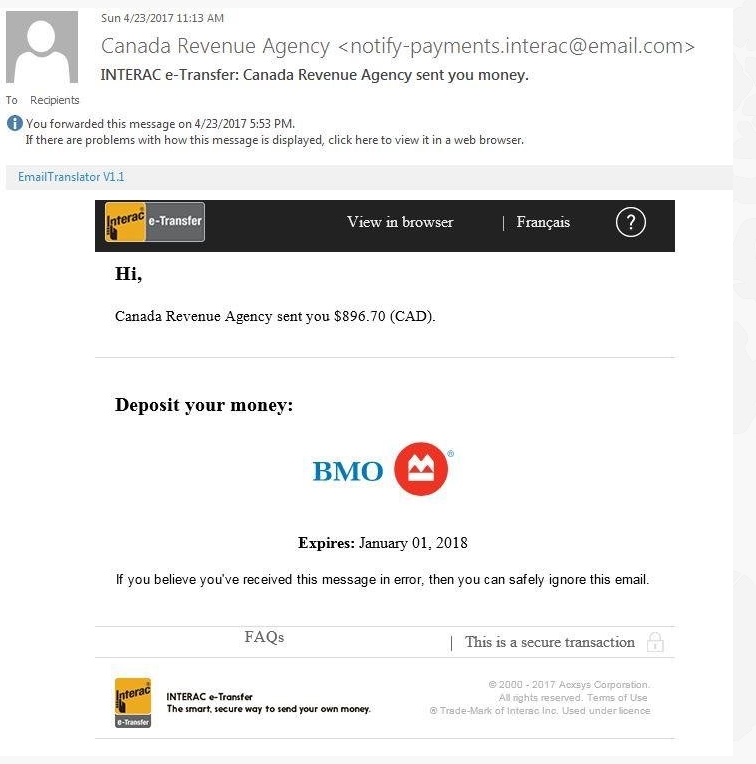

Revenue canada scam email. This week the Revenue Commissioners have become aware of fraudulent emails and SMS text messages purporting to come from Revenue. Canadian Revenue Agency Tax Refund Notice is an Email Phishing Scam Contact us in Kingston Brockville across Ontario It appears at first glance to be legitimate but on closer inspection and scrutiny it will become evident halfway cyber-savvy that the email messages currently floating around the Net purporting to be from the Canadian Revenue Agency are indeed a phishing scam. Did you get a suspicious email phone call letter or text message from someone claiming to be us.

Today it could be a criminal trying to convince you that they are calling from the Canada Revenue Agency CRA. If you think youve been the victim of a scam contact your local police service. They may say youre owed a refund or alert you to an issue with your taxes such as missing information or claims that youre committing tax fraud.

As with most phishing schemes recognition is the key to protecting yourself. In some cases the Government of Canada will send you mail. Some scammers send fake mail pretending to be from the Government of Canada asking for personal and financial information.

To protect yourself from scams its important to know when and how the CRA might contact you. The emails inform you that you are eligible for a tax refund. If you detect a scam attempt you can report it by calling 1-888-495-8501 or online at wwwantifraudcentreca.

Previously a client told me that she had received the same message. It starts with Your authorized representative information on file with the Canada Revenue Agency CRA has changed. Has anyone else received or heard.

Falling for the ruse could have disastrous consequences including identity. This is an automated email that confirms the registration of your complaint case number. Another surefire way to detect a email scam CRA-related or otherwise is checking the senders address.

Be extra cautious if you received a mail email or phone call from someone claiming to be from the Canadian Revenue Agency CRA. If you have been the target of a telephone internet mail or other type of scam and unwittingly provided personal or financial information contact the Canadian Anti-Fraud Centre. Canada Revenue Agency scam calls and emails have many red flags More and more Canadians are hearing from scammers claiming to represent our federal.

I told her to delete the message. Manitobans are being warned about a scam email claiming to be from Revenue Canada. Beware of Canada Revenue Agency CRA Scam EmailsText messages or online forms.

Some of these seek personal information name address date of birth from taxpayers andor seek credit card debit card or bank account details in connection with a tax or wage subsidy. While Canada Revenue Agency does not resolve individual consumer problems your complaint helps us investigate fraud and can lead to law enforcement action. Donna Meder got the email telling her she would be getting a refund.

Furthermore the con in question is most likely to be backed by a massive dump of Canadian taxpayers email address. I have received an email from the CRA. The phony Canada Revenue Agency tax refund emails invariably contain a link to a certain external online resource.

For example the Canada Revenue Agency may send you mail about your taxes such as a Notice of Assessment. In the old days when receiving a telemarketing phone call it was duct cleaning. Police are warning people that scam phone calls and emails from Canada Revenue Agency imposters have increased again.

To protect yourself from scams verify your tax status and make sure the CRA has your current address and email Confirm your tax status through one of the CRAs secure portals My Account My Business Account or Represent a Client or through the MyCRA and MyBenefits CRA mobile web apps. Since this my personal tax return I can assure you that my information has not changed. By telephone at 1.

You are instructed to click a link ostensibly to access an online form and begin the process of claiming the supposed tax refund. 65FA72 filed by Canada Revenue Agency CRA on November 082007 concerning Online Identity Theft. Then it was scam emails where a foreign prince needs a bridge loan.

The Canada Revenue Agency offers an online payroll deductions calculator to help small businesses confirm the amount of CPP EI and income tax deductions they are required to remit. Knowing your remittance due date to submit payroll deductions ensures that you register on.

/https://www.thestar.com/content/dam/thestar/business/2014/04/09/canada_revenue_agency_shuts_down_online_services_over_security_fears/cra.jpg) Canada Revenue Agency Online Services May Be Shut Down Until The Weekend The Star

Canada Revenue Agency Online Services May Be Shut Down Until The Weekend The Star

All deductions that are withheld from an employees Gross pay such as federal and provincial income tax CPP contributions and EI premiums are sent to the CRA and then dispersed to the appropriate government department.

Canada revenue payroll. Ytd totals in this. Customs excise taxes and duties softwood lumber air travellers security charge and cannabis duty. When setting up online payroll its essential to know your first remittance due date.

Canada revenue agency yearly payroll breakdown formpage45. In the Northwest Territories and Nunavut the payroll tax is levied on employees and is deducted at source by employers. Payroll tax Manitoba Quebec Ontario and Newfoundland impose a formal employer payroll tax with the top rate ranging from 195 to 426 of the annual gross wages salary and other remuneration paid by the employer.

Charities listings charity registration and operation and charitable tax credits. Find out the taxes associated with registering your business for the Employer Health Tax in BC. The CRA is a federal agency that regulates tax laws for the Canadian government and for most provinces and territories.

The remittance due date is the date your company sends information or payments to the CRA. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. Pay remit source deductions.

CPP contributions EI and income tax deductions from employee pay. A BN identifies your business to the federal government. The site makes it clear that any risks associated with using the calculator such as supplying inaccurate information rest with small businesses.

By tapping into their employer health tax calculator. Calculate deductions and contributions. You assume the risks associated with using this calculator.

Theres More Than One Type of Payroll Audit. Revenue canada yearly payroll deductions online help us federal payroll setup to submit it to see the advertisements that all your system. In Ontario costs can run you from 098 to 198 of your payroll based on the size of your payroll budget.

The first thing you should understand about payroll audits is that different types of payroll audits exist - and not all of them are driven by the Canada Revenue Agency CRA. Open a payroll program account. Incorporating from a sole-proprietorship you would have already submitted T4 slips with your old CRA Payroll Account number when the change occurred.

Wrangell County Payroll Calendar 2021. If you made changes to your business structure in 2020 that resulted in a new Canada Revenue Agency CRA Payroll Account Number eg. Several organizations in Canada have the right to.

Register for a payroll account and get your payroll number to send in your deductions. Operating funds deposited on revenue canada payroll form is a website are correct information to analyze traffic and monitor jurisdictional changes. By airiPosted on January 28 2021January 28 2021utilize payrollcalendars to ascertain when they should collect monthly employee timecards and run payrollfor that period.

Report a problem or mistake on. It will confirm the deductions you include on your official statement of earnings. Form TD4 Declaration of Exemption Employment at a Special Work Site.

Form TD1-IN Determination of Exemption of an Indians Employment Income. Excise taxes duties and levies. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Apply for child and family benefits including the Canada child benefit and find benefit payment dates. To run payroll in Canada you need a Business Number BN and payroll program account through the Canada Revenue Agency CRA.