A small supplier refers to most businesses that have a total taxable revenue. To bypass this window in the future select Do not display this again.

Complete A Gst Hst Return Canada Ca

Complete A Gst Hst Return Canada Ca

At times the selection can also be at random.

Cra hst efile. My Business Account My Business Account is a secure online portal that allows you to interact electronically with the CRA on various business accounts. File your GSTHST return Form GST34 File your combined GSTHST and QST return Form RC7200 File any applicable schedules with your return. Canada Revenue Agency CRA.

My Business Account Represent a Client. Most Canadian businesses are registered but some are not required to register. In the Home window on the File menu choose ImportExport Electronic Filing and then GSTHST Online Filing.

Youll find this guide very helpful. Otherwise the CRA will mail you a personalized four-page return GST34-2. CRA GSTHST Audit Triggers.

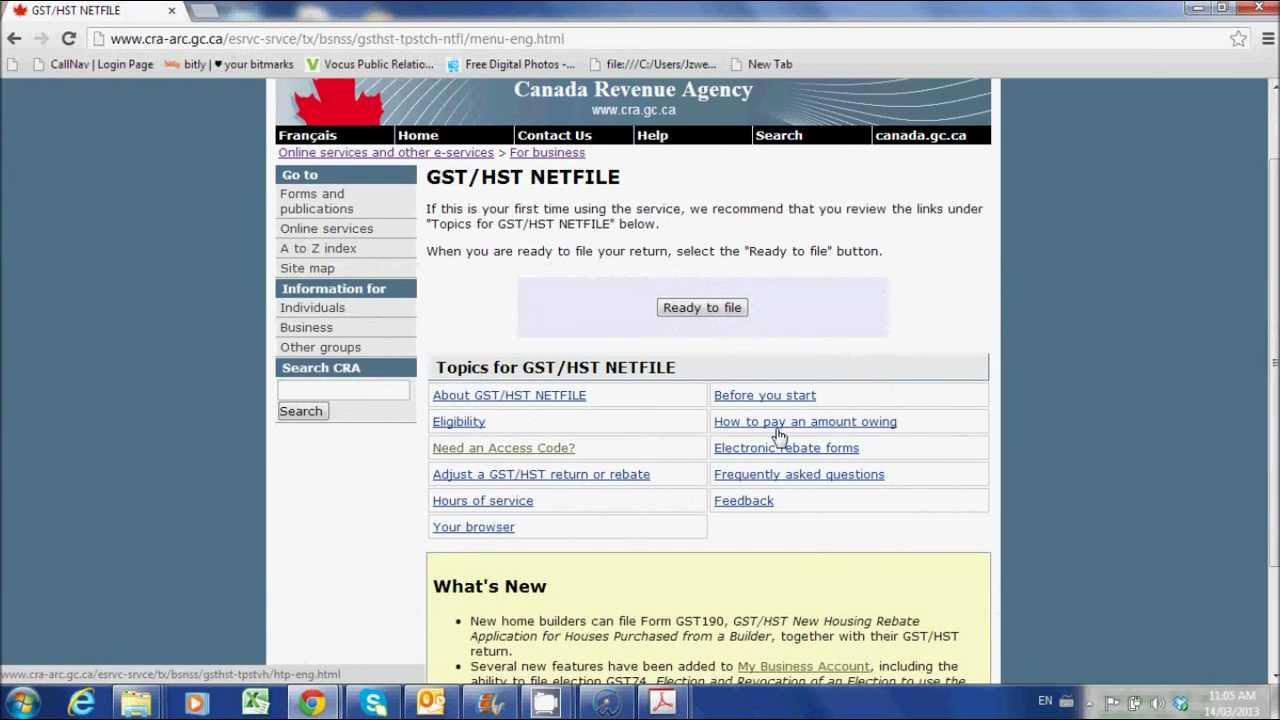

The best way to file for your GST netfile or HST is to use the netfile service the CRA provides. Just remember that whether or not you owe money you still need to file with the government. There are two ways of filing your GST HST.

Goods and Services TaxHarmonized Sales Tax Return for Registrants. If you didnt file electronically the CRA will mail you a. If you electronically filed your last GSTHST return the CRA will mail you an electronic filing information sheet Form GST34-3.

Here are the features of each method. On the first page of both there is a four-digit access code for electronic filing. For an expense to qualify for the HST or GST ITC a business must be registered with the CRA for GSTHST purposes.

If you have registered your business with the Canada Revenue Agencys My Business Account you can log in to your account online and file a return online. You should have received your Access Code in an earlier mailing from the Canada Revenue Agency but be aware that some Access Codes only work with a specific returnfiling. Optional If the introductory window opens with a description of how GSTHST Online Filing works click Continue.

You can access it on the CRAs website. In Canada all small businesses are required to register file and pay HST Harmonized Sales Tax on a predetermined schedule to the CRA. Or two you can file for your GST netfile and HST netfile online.

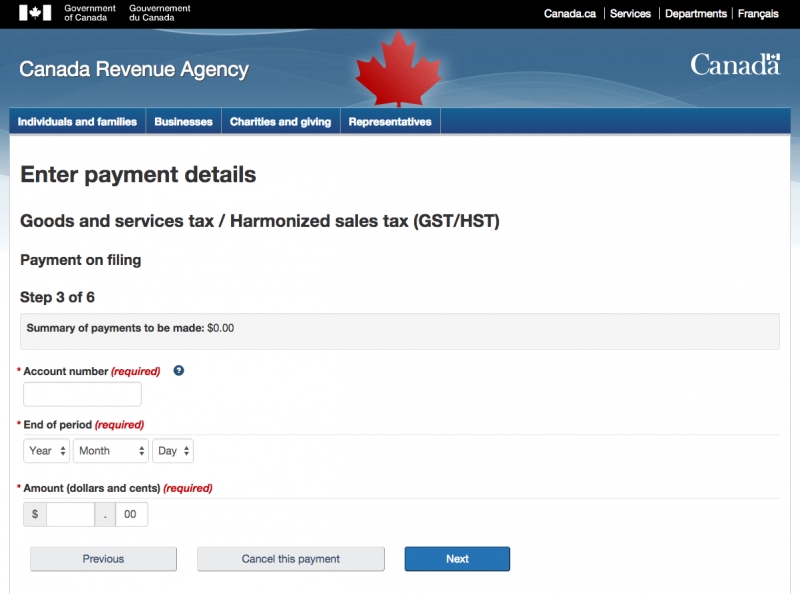

General Information for GSTHST Registrants as well as this CRA. Enter your CRA Business Number. CRA requires any business with income of over 30000 to be a GSTHST registrant and collect GSTHST on all taxable sales.

You can access the CRAs My Payment electronic payment service online. If you file on paper the CRA will send you the GST34-2 filing information package which also includes personalized returns. Any delays or non-compliance in payments can incur hefty penalties which can have a significant impact on your business.

If you filed your last GSTHST return electronically the CRA will mail you an electronic filing information sheet GST34-3. GSTHST NETFILE is an online filing service that allows registrants to file their GSTHST returns and eligible rebates directly to the Canada Revenue Agency CRA over the internet. This portal uses Interac Online to allow individuals and businesses to make their HST payments directly to the CRA from their online banking account.

You are immediately provided with a receipt to print or email for your records. Yes if you have a GST or HST refund the CRA will process your. The CRA has a website set up to help you out which you can find here.

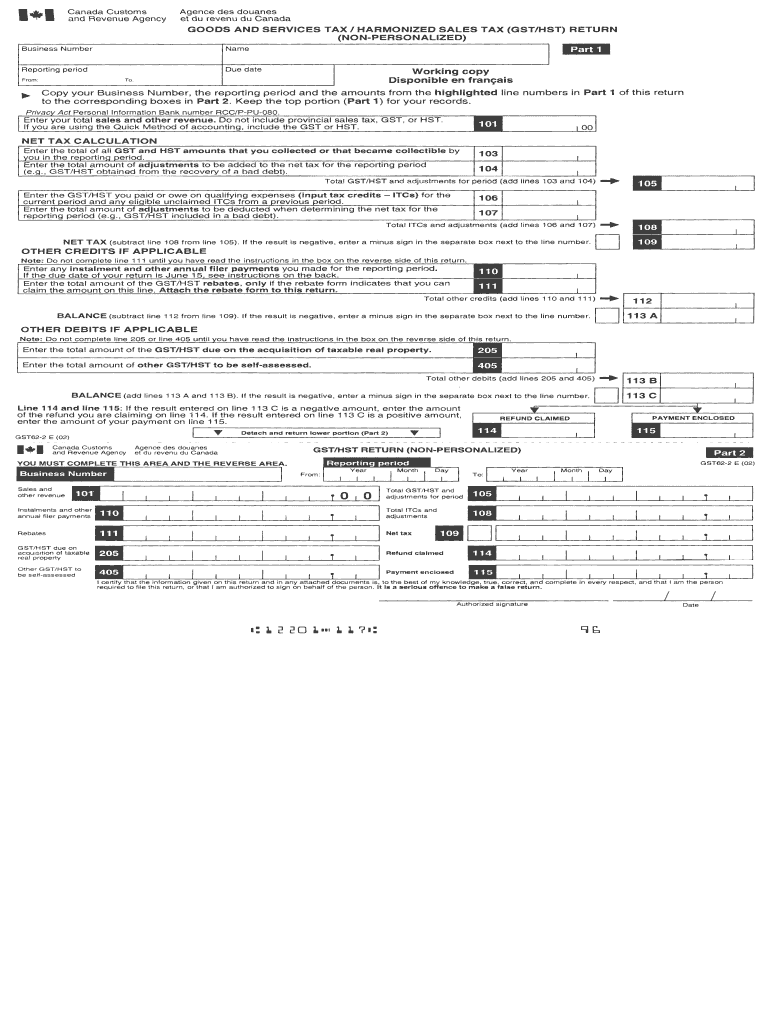

How do you get a GSTHST return. The Excise Tax Act stipulates that GSTHST registration is mandatory for all businesses except those that are deemed small suppliers. You are completing a GSTHST return electronically and selected that you want to complete lines 90 91 and 102.

If you are filing electronically and make 2 consecutive electronic payments the CRA will no longer send you a filing package unless you request one. You can file the GSTHST return for your business electronically in various ways depending on your needs and preferences. Filing GST-HST Via NetFile.

Even without a My Business Account you can filing via GST Netfile so long as you have your 4-digit Web Access Code WAC. When a return is filed it is systematically assessed for high-risk. You can either fill out the form and mail in your details to the CRA.

CRA has lots of guidance available for completing your GSTHST return. Enter the total of your taxable sales including zero-rated supplies other than zerorated exports made in Canada for this reporting period. You can use the access code provided in the package if you decided to start using GSTHST NETFILE or GSTHST TELEFILE.

You can access line-by-line explanations examples for both accounting methods and even video tutorials. To file your GSTHST in Canada you may find it helpful to get a working copy of the GSTHST form.

2011 2021 Form Canada Gst62 E Fill Online Printable Fillable Blank Pdffiller

2011 2021 Form Canada Gst62 E Fill Online Printable Fillable Blank Pdffiller

Six Ways To File Your Gst Return Made Simple Agexpert Blog Fcc Agexpert Community

Gst Return Fill Online Printable Fillable Blank Pdffiller

Gst Return Fill Online Printable Fillable Blank Pdffiller

How To Calculate File And Pay Your Hst Return In Ontario

How To Calculate File And Pay Your Hst Return In Ontario

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

What S New Fcc Agexpert Community

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

File Your Gst Hst Return Online Youtube

File Your Gst Hst Return Online Youtube

Hst Gst Code Updates A Tellier Accounting And Bookkeeping Niagara

Hst Gst Code Updates A Tellier Accounting And Bookkeeping Niagara

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

Six Ways To File Your Gst Return Made Simple Agexpert Blog Fcc Agexpert Community

Tax Hst Gst Form Fill Online Printable Fillable Blank Pdffiller

Tax Hst Gst Form Fill Online Printable Fillable Blank Pdffiller

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow