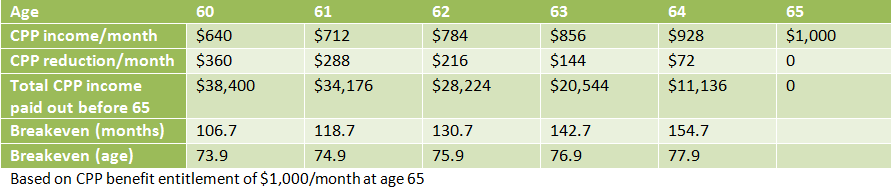

If you take early CPP the reduced CPP benefits after 65 will be offset somewhat by increased GIS benefits. To qualify for the maximum monthly CPP you need to contribute to the CPP for at least 83 of the time you are eligible between age 16 and 65 ie.

3 Reasons To Take Cpp At Age 70 Boomer Echo

3 Reasons To Take Cpp At Age 70 Boomer Echo

GIS is not taxable.

Cpp after 65. If you wait until age 70 you will receive 42 more. If you are at least 65 years of age but under 70 you can elect to stop contributing to the CPP. To get the maximum CPP you need at least 39 years of maximum contributions between age 18 and 65.

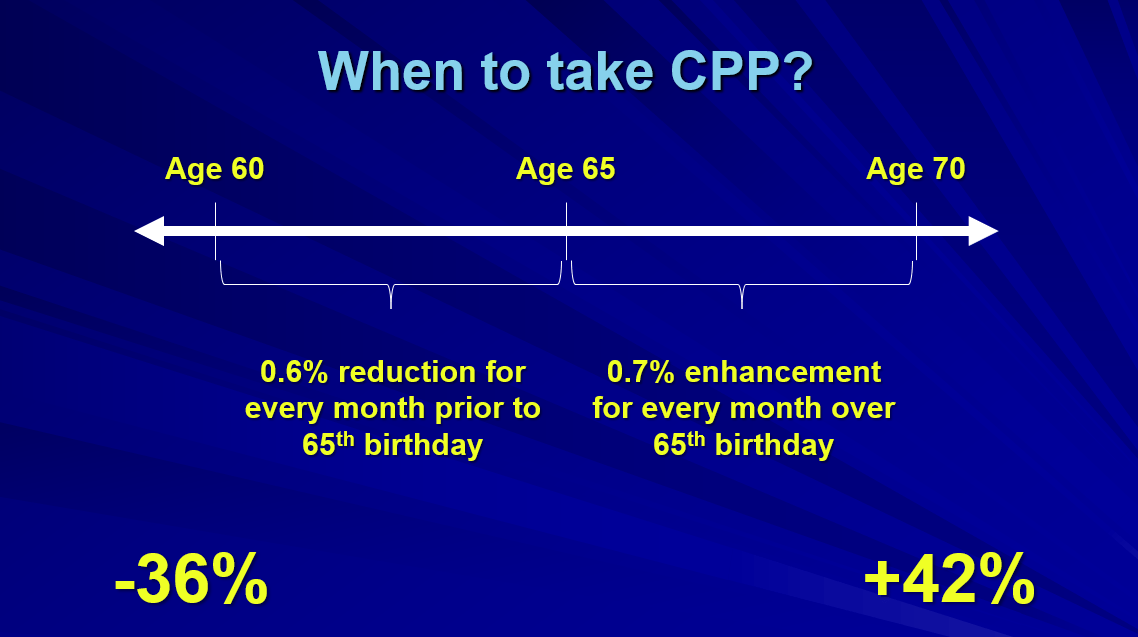

As a CPP working beneficiary you have to contribute to the CPP. There is never any harm in stopping CPP contributions after 65 other than your current CPP income will no longer grow. It is reduced by 06 for every month before your 65th birthday you start taking your CPP.

The maximum monthly payout in 2020 is 117583 although youll only. Those contributions will not add a single cent to their benefit. If you were to claim at 65 the CPP would base the benefit payments on the best 39 years of earnings.

Due to schooling breaks in employment early retirement etc many people never reach the maximum. Taking CPP at 65 is a good middle-ground option if. But in this article Im going to explain why you shouldnt take CPP at age 65.

If an individual already has 39 years of maximum contributions at age 65 and they do not opt to take their CPP at age 65 and are still working they are also required to keep making contributions up to age 70. To stop contributing you must fill out form CPT30 Election to stop contributing to the Canada Pension Plan or revocation of a prior election. Should you wait to start collecting CPP.

The start date you choose to begin receiving your benefit will affect how much youll receive each month. Thats 72 per year. So after age 65 the extra monthly CPP you get for waiting and applying at age 65 actually reduces your GIS.

65 to 70 years of age and working. And in those 39 years you must have made the maximum contributions as per the Yearly Maximum Pensionable Earnings YMPE. The typical age to start collecting your CPP is 65.

CPP payments are based on a number of different factors. The average amount Canadians get when taking CPP at 65 is 736 while the maximum is 1175. For every month you start collecting your CPP payments before the age of 65 you lose 06 of possible payments you can collect.

If they were earning at least 58700 they would be paying in 2898 in CPP contributions as would their employer but with no additional benefit. For 2021 the YMPE is 61600. Since the new changes to CPP were implemented January 2012 you have been able to choose whether to contribute to the CPP after reaching age 65 up to age 70 but only if youre receiving your CPP retirement pension.

The method to stop contributing to the CPP is different if you are an employee only self-employed or if you are both an employee and self-employed. If you apply after you turn 65 you can get retroactive payments of the CPP retirement pension for up to 11 months. There are no retroactive payments for a CPP retirement pension taken before age 65.

Starting at age 65 you can choose not to contribute to the CPP. CPP contributions are mandatory for working CPP retirement pension recipients under age 65. In previous articles Ive looked at reasons to delay taking CPP until age 70 along with explanations why you might want to take CPP earlier at age 60.

This basically means that if you dont apply for your CPP retirement pension at age 65 you will have to live for approximately 12 years after whatever age you do apply for it to start in order to catch up on the CPP retirement pension that you have foregone. Conversely if you delay receiving your CPP until age 70 your payments will be permanently increased by 07 for every month after your 65th birthday you delay or 84 per year. The default however is that contributions are mandatory until age 70 unless you elect not to contribute.

The most compelling reason to defer CPP is the increase or enhancement of your benefit - 07 percent for every month you delay past 65. However it is important to note that by receiving the CPP or QPP pension early you will receive a reduced amount that continues to be paid at the reduced rate after age 65. If you are still working when you hit age 65 you may choose to contribute to CPP or not.

The bridge benefit will continue to be paid until age 65 even if you choose to receive an early or late CPP or QPP retirement benefit before or after age 65. These factors mean that most people do not qualify for the maximum CPP benefit at age 65.

3 Reasons To Take Cpp At Age 60 Boomer Echo

3 Reasons To Take Cpp At Age 60 Boomer Echo

Should I Take Cpp At Age 60 Money Coaches Canada

Should I Take Cpp At Age 60 Money Coaches Canada

When To Take Cpp In Retirement A Case Study Cashflows And Portfolios

When To Take Cpp In Retirement A Case Study Cashflows And Portfolios

Why You Shouldn T Take Cpp At Age 65 Boomer Echo

Why You Shouldn T Take Cpp At Age 65 Boomer Echo

When Is The Best Time To Take Cpp Fraser Partners

When Is The Best Time To Take Cpp Fraser Partners

Collecting Cpp But Still Working Understand Your Post Retirement Benefits

Cpp Rule Change Working And Contributing After 65 Carp

How To Apply For Your Cpp Canada Pension Plan Early And Should You

How To Apply For Your Cpp Canada Pension Plan Early And Should You

Spreadsheets And Financial Basics Financial Studies 2 Start Cpp Earlier Or Later Than 65

Spreadsheets And Financial Basics Financial Studies 2 Start Cpp Earlier Or Later Than 65

What In The Direction Of Conjecture Since Cpp After That Oas Cpp Age 60 Vs 65

What In The Direction Of Conjecture Since Cpp After That Oas Cpp Age 60 Vs 65

What Age To Start Your Cpp Retirement Pension Canada Ca

Should I Delay Cpp Oas Until Age 70 Complete Answer With Real Life Examples Ed Rempel

Should I Delay Cpp Oas Until Age 70 Complete Answer With Real Life Examples Ed Rempel