I received a T4 form one of three i had for 2019 from one of my employers back in February but for some reason it is not under My Account on the CRA site. Employers are regulated to send out T4s by February 29 2020 at the latest.

Take an look at the CRA instructions here.

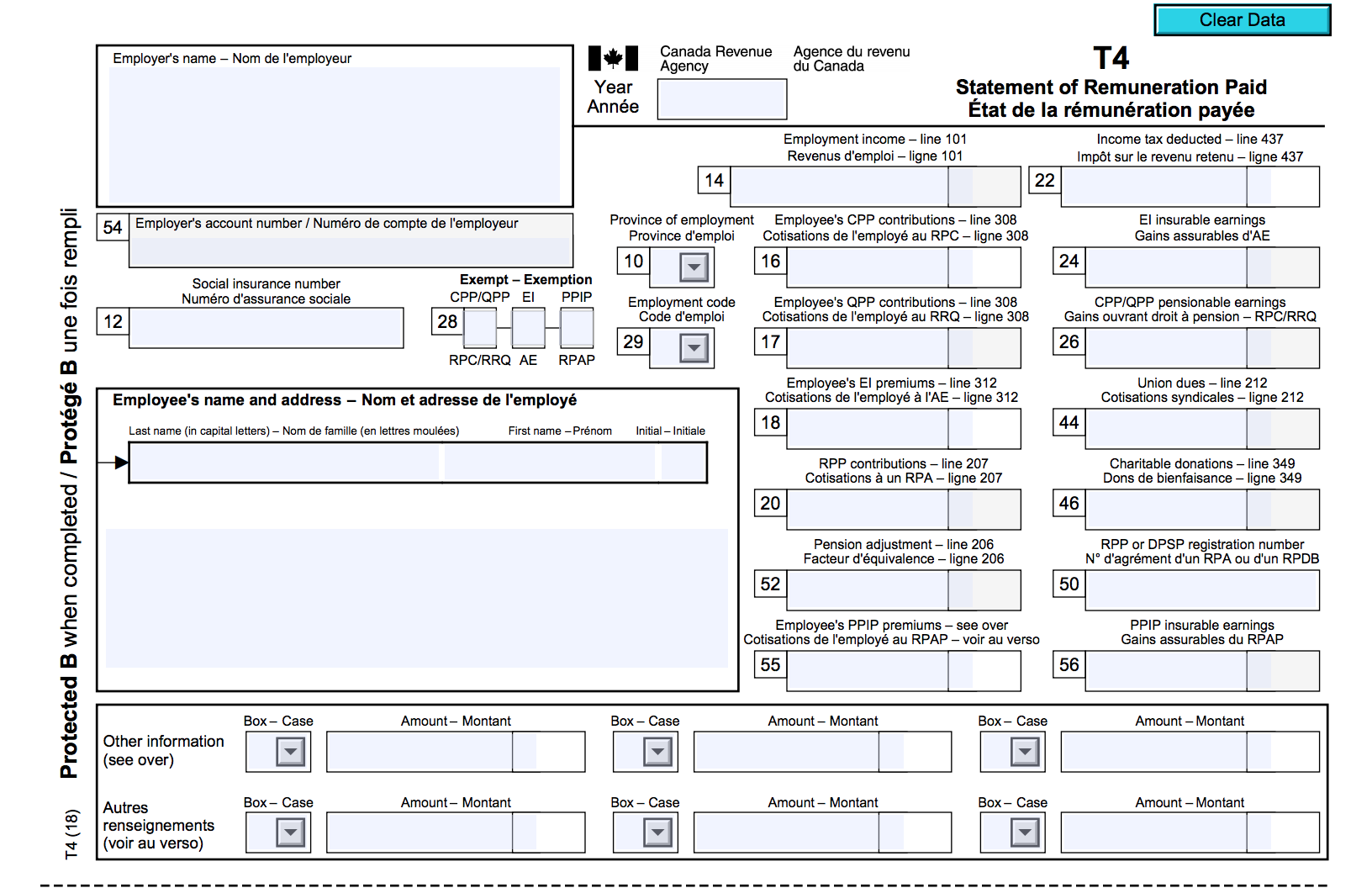

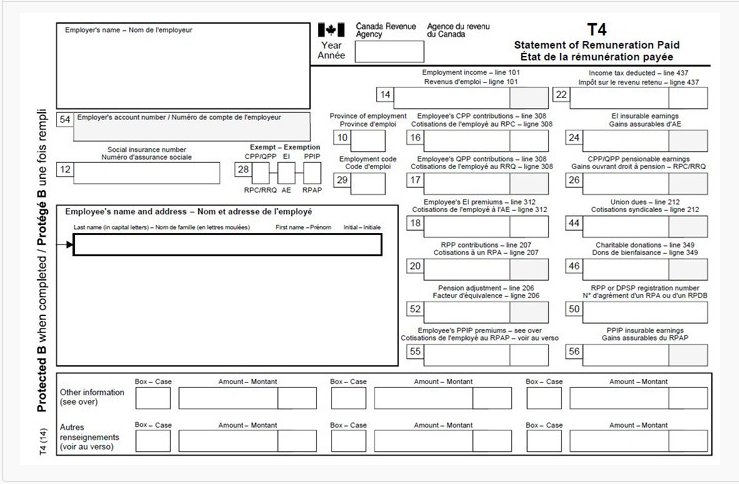

Cra missing t4. T4A Statement of Pension Retirement Annuity and Other Income. The information from the T4 Statement of Renumeration Paid slip is very important for preparing and filing an accurate tax return with the Canada Revenue Agency CRA. Not only does it include how much income you earned but it also shows how much you have contributed to Employment Insurance EI Canada Pension Plan CPP and how much tax youve already paid for the year.

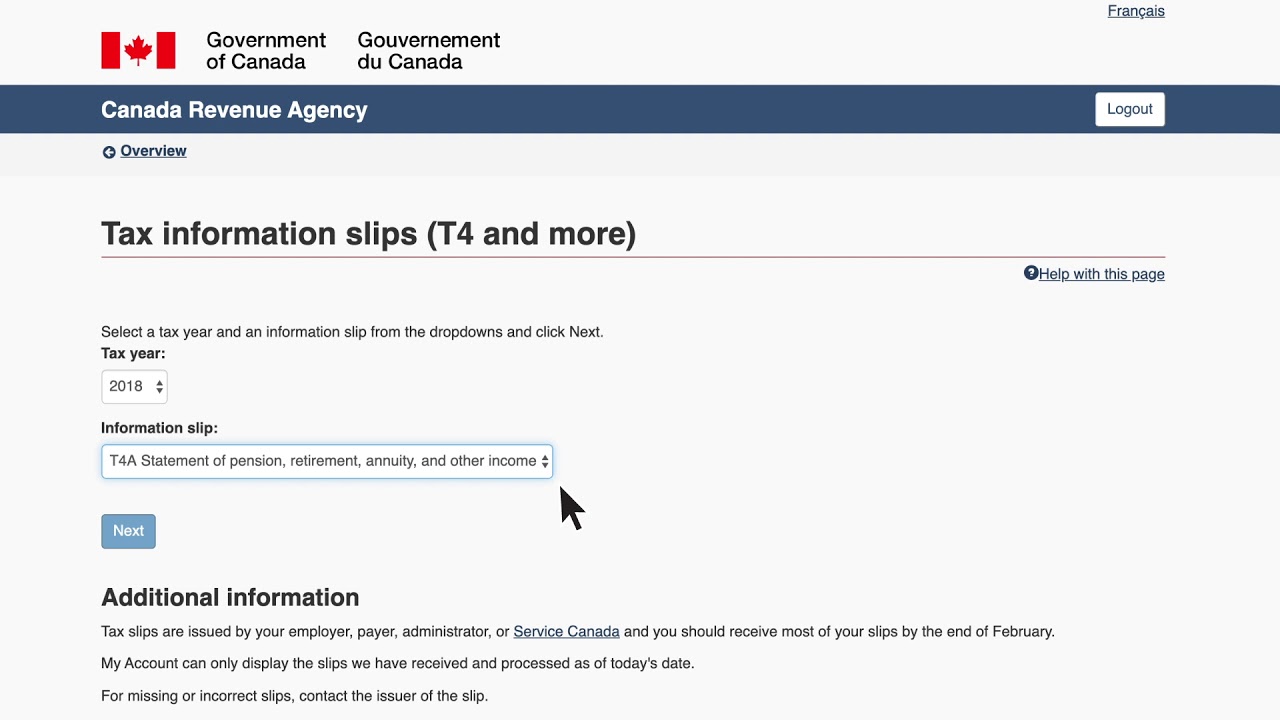

You do have to include the income received from that source as well as the tax deducted. If you issue paper T4 slips to replace copies that are lost or destroyed do not send the CRA a copy. When you open that menu and see the T4 slip youre missing select it.

These types of information returns follow the penalty structure under the relieving administrative policy. T4AOAS Statement of Old Age Security. If you have lost the tax slip or have not received it in the current year check you CRA My Account.

To verify all your tax slips that the CRA has on file particularly ones that relate to investments you can call the Individual Enquiries line at 1-800-959-8281. Youre also going to see a column labelled Type. Call the CRA Only some of your tax slips will show up in My Account namely the slips that begin with T4.

Choose your different documents e. If you are calling the CRA on behalf of someone else you must be an authorized representative. If you need a T4 slip for the current tax year your employer should be able to provide it to you.

For previous tax years you can request a copy from the Canada Revenue Agency CRA or by calling 1-800-959-8281. View a copy by using My Account or the CRA Mobile App. If you are an employee who has not received your T4 slip or you have questions about amounts contact your employer or go to Tax slips.

I was told that I could get the T4 from CRA but I am confused here. T4E Statement of Employment Insurance and Other Benefits. If you are missing a T4 slip you should be able to obtain it from CRA by signing in to your Online CRA My Account and retrieving it from there.

Get Your T4 and Other Tax Forms Online From CRAs Auto-fill my return. If you have forgotten to report income you do need to make sure that you report it as opposed to waiting for CRA to find it. Yukon Northwest Territories and Nunavut.

First making a request too early could lead to unnecessary delays in processing time for both the original return and the adjustment. My employer claims they sent it to the CRA in February and the CRA said its. T4A Statement of Pension Retirement Annuity and Other Income.

Outside Canada and US. T4AP Statement of Canada Pension Plan Benefits. T4RIF Statement of income from a Registered Retirement Income Fund.

T4RSP Statement of RRSP Income. But sometimes addresses and contact information change things slip through the cracks and youre stuck without a. Your CRA My Account will also allow you to use AutoFill which will import this slip directly in to your tax return.

If you are not signed up you can call CRA and request the slip 1-800-959-8281. T4 slip On the page that loads from there youre going to see more information regarding the T4 slip in question such as the name of your employer and when it was issued. Hi Im having the following issue.

T4 Statement of Remuneration Paid. Hello everyone I have every document except for the last T4 from my current company. T4 Statement of Remuneration Paid.

Contact CRA they will give you the right procedure for filing with a missing T4. You will need to fill in a T1Adjustment form and return it to Cra. You can either print this form or go on the site above and fill in directly information about your 2014 T4.

CRA missing a T4 form. Clearly identify them as DUPLICATE copies and keep them with your records. Even if youre not with the same employer they are still obligated to send you a T4.

Do I have to contact CRA and get a print copy from them OR I could print the T4 webpage from my. You do not report those on your T4 slip. Second CRA could adjust your original return for you.

Your employer has until the end of February of the following year to issue you a copy of your T4 slip for any income earned in the previous year. Missing T4A OAS Tax Slips If you do not receive your T4A OAS tax slip contact Service Canada at 1-800-277-9914 during regular business hours. NR4 Statement of Amounts Paid or Credited to Non-Residents of Canada.

Employers are required to provide T4s by the end of February.

T4 Slip Lost Here S How To Access Lost Or Old T4 Slips

T4 Slip Lost Here S How To Access Lost Or Old T4 Slips

The Blunt Bean Counter The Cra S Matching Program Mismatch And You May Be Assessed A 20 Penalty

The Blunt Bean Counter The Cra S Matching Program Mismatch And You May Be Assessed A 20 Penalty

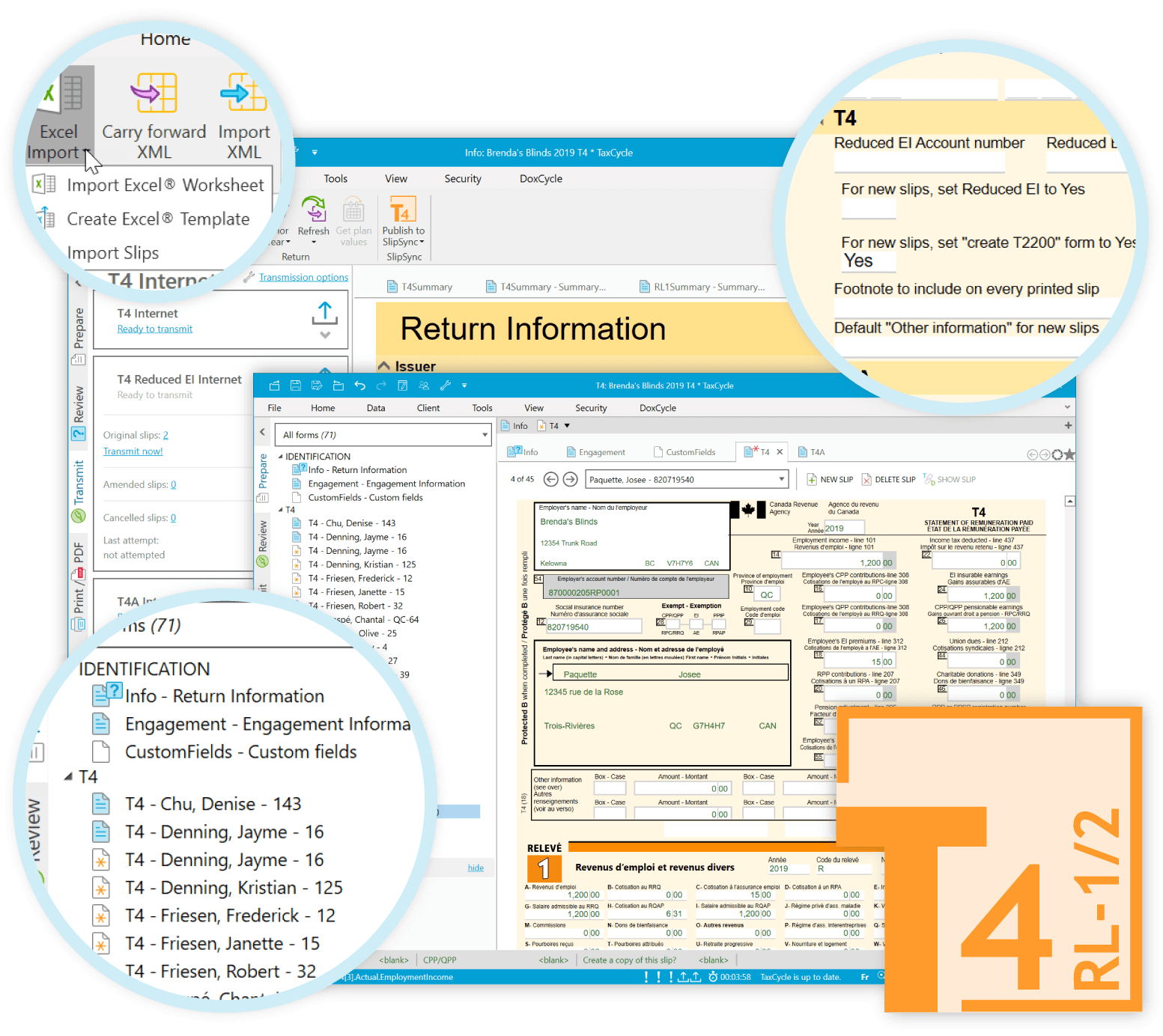

T4 Return Tips For Canadian Employers Wave Blog

T4 Return Tips For Canadian Employers Wave Blog

How To Recover A Missing Tax Slip Simplecpa

How To Recover A Missing Tax Slip Simplecpa

The Canadian Employer S Guide To The T4 Bench Accounting

The Canadian Employer S Guide To The T4 Bench Accounting

/Canada-5b6b746046e0fb00259bb02a.jpg) T4a Oas Tax Slips For Canadian Income Tax Returns

T4a Oas Tax Slips For Canadian Income Tax Returns

4 Important Things You Probably Aren T Noticing On Your T4 Tax Slip National Globalnews Ca

4 Important Things You Probably Aren T Noticing On Your T4 Tax Slip National Globalnews Ca

Income Tax Common Mistakes Made On Tax Returns Ctv News

Income Tax Common Mistakes Made On Tax Returns Ctv News

How To Request A T4 From Canada Revenue Agency 2021 Turbotax Canada Tips

How To Request A T4 From Canada Revenue Agency 2021 Turbotax Canada Tips

The Cra Has Our Tax Data So Why Are We Still Filling Out These Crummy Forms Financial Post

The Cra Has Our Tax Data So Why Are We Still Filling Out These Crummy Forms Financial Post

Missing A Tax Slip Here S How To Find It And What Happens If You Don T Liveca Llp

Received Cerb Payments Watch Your Mailbox For T4a Tax Slips From The Cra National Globalnews Ca

Received Cerb Payments Watch Your Mailbox For T4a Tax Slips From The Cra National Globalnews Ca

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp